Free preview: Social Housing's diversification report

Social Housing magazine is providing a preview of our exclusive special report.

Your subscription provides you with unlimited access to all our current and archived special reports, our website, our monthly print edition and weekly newsletter. Click here to find out more about how to subscribe.

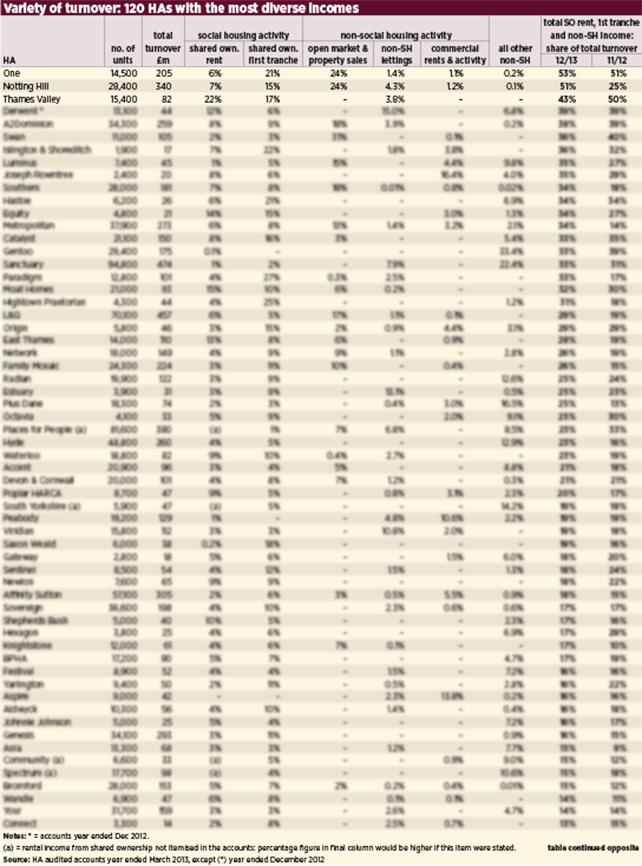

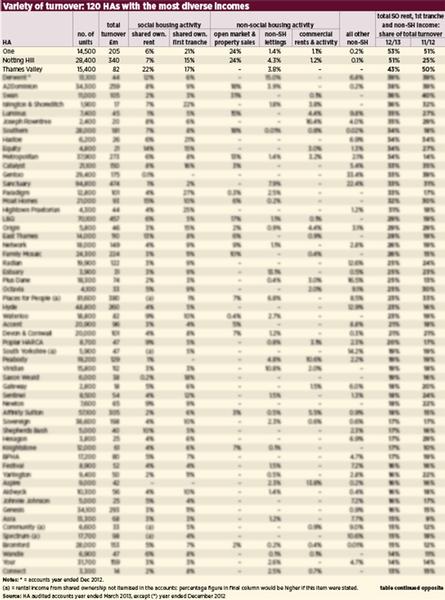

Diversified activities provide £2.3bn of housing association turnover

Thirty-four social landlords are already generating a fifth of their turnover from non-core income.

Housing associations have increased their income from diversified activities including market sale and private rent by a quarter.

The total revenue that 120 HAs generated from non-core social housing activity increased by 25.2 per cent to £2.3bn.

From market sale to agricultural lettings, private rent to leisure centre management, the results show an increasingly diverse and complex social and affordable housing sector.

While many HAs have embarked on or continued with commercial activities as a form of cross-subsidy in response to lower grant rates and what some consider increasingly onerous requirements to win funding, the figures also incorporate activity such as community-based work and care and support (where classified as non-social housing in the accounts).

This report looks at the most-diversified 120 HAs in the sector by proportion of their turnover, which ranges from 53 per cent to just 3 per cent.

Analysis of the 2012/13 accounts - the latest comprehensive primary source of financial information across the sector - shows that diversified activities made up 19.3 per cent of the total £12.2bn of income across these groups.

While diversified activity rose by 25 per cent in the 2012/13 year, from £1.88bn in 2011/12, total turnover across the group of HAs rose by 19.3 per cent.

The result was an uptick in the overall proportion of turnover that is made up of diversified activity, from 17.1 per cent to

19.3 per cent.

This report shows that while some HAs are looking to expand further into commercial markets to make up a shortfall in grant funding and the subsidy that makes sub-market rent viable, 34 HAs already rely on diversified income for more than a fifth of their group turnover.

Context

Like surpluses, the sector will be keen to stress that earnings from many of these activities will be invested back into core activity of building and managing affordable and social rented homes, and providing enhanced services to tenants.

Both the Home and Communities Agency and Greater London Authority 2015-18 funding programmes called on bidders to maximise ‘cross-subsidy’ from both asset management and other activities, primarily the provision of open market housing.

Concurrently, the regulator has been placing increased focus on the need to protect social housing assets from commercial activities.

It means many HAs will now be approaching their business plans in the context of the overall housing market, rather than affordable or social housing in isolation.

Many groups also see their role as ensuring provision for the vast ‘middle ground’ between low cost housing and the private sale market.

As set out by the regulator, this all means that the sector is more exposed to the cyclical nature of the housing market.

Defining diversification

For many, shared ownership would be considered part of the social purpose, though like other diversified activities, it means an exposure to broader housing market fluctuations.

Other key activities include open market and property sales.

Our ‘non-social housing lettings’ segment includes market rent, student rent, intermediate rent and other rent activities.

Commercial rents - including office and retail income - is categorised alongside a number of activities, including income from agricultural lettings, property investment and land sales.

That category also covers revenue from retirement villages, registered care homes and nursing homes.

All other non-social housing activity includes a wide mixture of interests, such as management services, community regeneration and income from community-based works.

It also includes leisure facilities management, regeneration and development services, and income from training and consultancy.

Trends

Two standout figures at the centre of this report are the acceleration of market sales and shared ownership first tranche sales.

Across the 120 social landlords, market and property sales increased by 51 per cent year-on-year, taking their income to £515m…..

Individual HAs

One Housing Group (OHG) tops the diversified table with 53 per cent of income from non-core activities, driven largely by market sale - developed by 17 subsidiary companies - and shared ownership sales.

Notting Hill Housing is second down the list, with 51 per cent of its income from non-core social housing activities. However, it should be noted that this takes in a significant proportion of shared ownership rents and sales, which some might consider part of its core activity.

Other groups with significant market sales programmes include Swan, where almost a third of the income is from private development.

Managing risk

The increasing diversity of the social housing sector is a key focus of the regulator.

As HAs look for alternative funding routes, more are finding ways to leverage non-social housing assets to raise finance.

This has been seen most recently through the transactions conducted by Legal and General, which has been willing to charge security against key worker and care schemes.

As HAs build up their private sale and rented portfolios however, it could well signal a new form of financing that is more akin to the commercial lending market.

Why subscribe to Social Housing magazine?

Subscribers to Social Housing magazine receive access to over 15 exclusive reports published throughout the year, along with an online library of archived reports carrying a wealth of data that enables you to track trends across the social housing sector on anything from capital commitments, financial results, asset sales, affordable homes programme allocations and investment, staff pay & turnover and executive pay.

Social Housing has been the sector’s respected go-to financial publication and point of reference for the last 25 years, providing an objective monthly insight into the most significant finance, business and governance developments across the sector. We also publishes regular online news and weekly newsletters.

Click here to subscribe to Social Housing magazine: see our new ‘online only’ offer

We provide in-depth news coverage and analysis of housing funding deals, partnerships and projects, with a level of detail you won’t find anywhere else. The magazine also carries comment and technical columnsfrom leading members of the sector, interviews and analytical features, along with a Businesswatch section that tracks financial trends.

Read predominantly by the housing sector’s chief executives, finance directors and senior practitioners, along with financiers, professional services and the supply chain, the magazine also covers senior appointments and is used to advertise executive-level job vacancies.

We hold two high-level conferences each year attended by directors from across the sector. Our next event is the annual conference in November 2014.

Your subscription provides you with unlimited access to our website, our monthly print edition and weekly newsletter. Click here to find out more about subscribing.

RELATED