Notting Hill vs Taylor Wimpey: Moody's compares housing associations and homebuilders

Housebuilders have more nimble capital structure and proactive approach to market conditions, while housing associations can flex activity and benefit from ‘extraordinary’ support of UK government, says Moody’s.

Source: Moody’s

Credit rating agency Moody’s has published a new report drawing comparisons between housing associations and homebuilders.

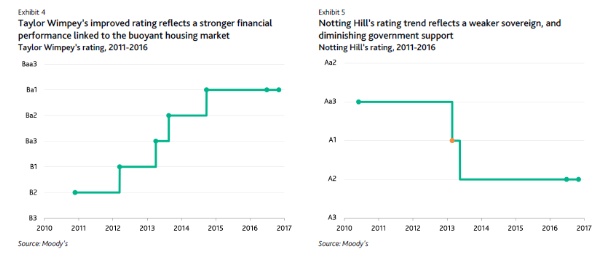

It focuses on Taylor Wimpey, which is rated at a ‘speculative grade’ Ba1 with a stable outlook, and Notting Hill Housing Group, which has an ‘investment grade’ A2, with negative outlook.

The analysis comes against a backdrop of housing associations’ increasing sales activities and following a number of recent debates on the topic and views on understanding the ‘tipping point’ between the sectors. It was the focus of a session at the Social Housing Annual Conference on 10 November 2016, where one banker said a two-notch movement in a credit rating from ‘A’ to ‘bbb’ moves pricing by around 42 basis points on average.

Jeanne Harrison, analyst at Moody’s - who also spoke at the conference and has warned about the risk associated with responding to the UK government’s calls for associations to build more homes - has authored the report.

The research says UK housing associations (HAs) are more creditworthy than commercial homebuilders, but that ‘HAs’ growing exposure to property development has brought about some convergence between the two sectors’.

‘Homebuilders, whose ratings are typically speculative grade, have more flexible capital structures thanks to their generally lower debt burdens,’ Ms Harrison says in the report.

‘However, the HA sector has the advantage overall because of the counter-cyclical nature of its core social housing lettings business, its close government ties, and its greater operational flexibility.’

Moody’s-rated HA portfolio as a whole relied on sales for 8 per cent of its turnover in the year to March 2015. But it is expected to increase, making cash flows less predictable and increasing their vulnerability to housing market downturns, especially if their debt burdens are increasing at the same time.

Notting Hill generated 36 per cent of turnover from market sales in 2015/16.

Capital structure

Source: Moody’s

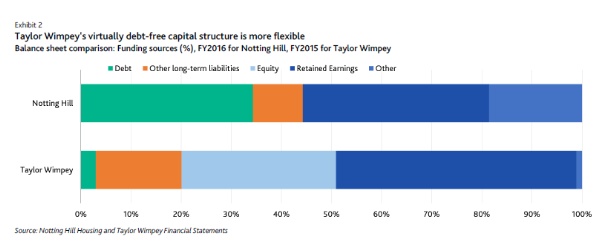

The report highlights the more flexible capital structures of a housebuilder, pointing out that Taylor Wimpey primarily funds its business with equity and retained earnings, with some reliance on land creditors.

It says this capital structure is better suited to the unpredictability of the commercial property market.

Meanwhile, paying shareholder dividends at its discretion means the company has greater financial flexibility than largely debt-funded HAs. For example, Notting Hill faces mandatory annual interest payments of £75m - or 15 per cent of revenues - on average over the next five years, and therefore needs to generate predictable cash flows.

It adds that strong liquidity is critical for both. Taylor Wimpey aims to maintain liquidity headroom of undrawn committed facilities over peak forecast requirements of at least £250m. Notting Hill maintains sufficient cash and credit lines to cover the higher of its development program, or its 18-month cash requirement.

Reading the market

The report adds that homebuilders are generally more proactive in adapting their strategies to external market conditions. It says Taylor Wimpey’s 2015 strategic report recognises that the UK housing market is currently in a ‘growth’ phase which will inevitably be followed by a downturn, so its financial strategy is currently focused on cash conversion.

The report makes the point despite Taylor Wimpey suffering billion-pound losses at the last downturn in 2008.

Nonetheless, Moody’s says the cyclical approach contrasts with most HAs’ development strategies, which are based on a targeted number of homes built, irrespective of macroeconomic trends.

HAs are also less proactive in managing market sales exposure through the cycle, with much of the associated risk assessed at the development scheme level, or in the final stages of the planning process through stress testing.

Despite the possibility of a market downturn, Notting Hill’s business plan foresees a continued high level - more than 20 per cent of turnover - of market sales exposure, and a near doubling of debt with an additional £1.1bn of borrowing over the next five years to fund housing development.

The report says: ‘The trend of increased borrowing and rising exposure to market sales in the HA sector will weaken its credit quality overall.

‘We would expect the sector to begin aligning its market sales and development plans more closely with the market cycle as its exposure increases.’

Flexibility

However, Notting Hill is clearly strengthened by the substantial rental demand for its social housing stock and the value of its housing assets.

It also has greater operational flexibility, with the main credit advantage being that it can scale back or even halt its housing sales activities, and ‘fall back’ on its core social housing lettings business.

For those units built without government funding, Notting Hill has ‘substantial flexibility’ to convert tenures from sale to rent or vice versa to adjust to market demand.

‘This counter-cyclical and reliably profitable business generated £215m of turnover and a 35 per cent operating margin in FY2016, surpassing Taylor Wimpey’s margin of 25 per cent,’ the report says.

It points out that HAs use sale proceeds to fund development, but could operate without them, while for homebuilders such as Taylor Wimpey have property sales is their sole revenue source, making the company more vulnerable in a market downturn.

Government-backed

One clear differential is government support.

The report reiterates that HAs are closely tied to the sovereign through government-funded rental payments and regulation, underpinning an expectation that they would receive extraordinary government support in the event of financial distress.

Moody’s says that while it estimates that the HA sector’s links to government have weakened in the past few years, Notting Hill’s rating benefits from a two-notch uplift as a result of state-backing.

Despite schemes such as Help to Buy, the report stresses that housebuilders’ ‘primary objective is to generate investment returns for their shareholders’.

‘We therefore do not assume that the government would support a private homebuilder facing liquidity distress, as we do in the case of HA,’ it adds.

Response

Paul Phillips, group finance director at Notting Hill, said: ‘We were pleased to see the Moody’s publication of a comparison between the finances of Notting Hill and Taylor Wimpey that reinforced the strong credit metrics of major registered providers like Notting Hill.’

RELATED