Getting off the fence when it comes to how we report hedge accounting

Is it out with the old, in with the nuanced?

There are two basic questions with hedge accounting: how to document it and how to do it.

For most accounting topics there is little ‘documentation’; you figure out what you did and do the debits and credits. But for hedge accounting apparently reporting entities cannot be trusted to maintain a consistent narrative, and to enter the hedge accounting garden of delights one needs to ‘document’.

The reason, reflected in accounting standards and audit practices, is of course that reporters have on occasion proved that they indeed cannot be trusted when faced with the allure of manipulating their results. There is an interesting parallel with the role of ‘intention’ in many matters of taxation. Truth is in the eye of the beholder… but this risks becoming an article about something else…

In principle, the FRS 102 documentation requirements are not hard to satisfy. However, the difficulties can start when one begins to model individual transactions in detail and understand their performance under stress.

Hypothetical derivatives

Readers are probably familiar with the wonderful concept of the ‘hypothetical derivative’ used for ‘cash flow’ hedges. The basic proposition is that one cannot just say: “It is an interest rate swap, we have floating-rate loans, it is a hedge.”

Instead, one compares the mark-to-market (MTM) movement of the actual swap (or whatever the product being treated as a cash flow hedge is) to that of a swap which would have been a perfect hedge for the loan cash flows (hedged item).

The two may move in a similar manner with small differences for roll periods, maybe counterparty risk, for example. One then can take the smaller of the offsetting value movements in the actual and hypothetical swaps, and report that as a movement in the cash flow hedge reserve (‘CFHR’) rather than P&L, with the remainder of any actual movement in P&L.

‘Inception MTM’

However, as is often the case when applying supposedly simple rules to the real world, complexities can arise with unusual products or circumstances.

A good example is derivatives with a large ‘inception value’. This is where at the start of the hedge relationship the swap had a material MTM – for example because the instrument was restructured on that date from something not eligible for hedge accounting such as a cancellable trade.

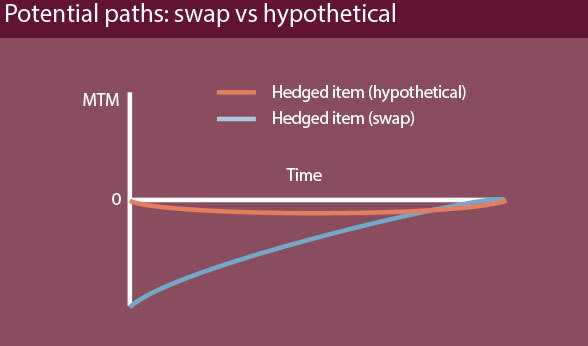

We might take a simple example, of a swap which had inception MTM of negative £5m. The graph above represents the potential path of the movement in the swap and hypothetical if nothing exciting happens to interest rates.

One could take a simplistic view to applying hedge accounting here: strip out the ‘day one’ MTM and amortise it in a straight line until maturity, then use the difference between the value movements in the actual trade sans amortised inception MTM and the hypothetical to determine what to book against CFHR. This is not a great method as the present value calculations do not follow nice straight lines; more importantly it isn’t what the standard says and there is little chance of such a simple method being seen as adequate.

“The difficulties can start when one begins to model individual transactions in detail.”

The market standard method is in some ways simpler still: report the smaller of the actual and hypothetical MTM movements in the CFHR, ignoring whether there was inception MTM. This is also not a great method. Valuation movements may be dominated by the passage of time and you can get quirky ‘hedge effectiveness ratios’, such as zero per cent of the movement in MTM of the actual being offset by movements in the hypothetical (when really you wanted something relatively close to 100 per cent, even if the 80-125 per cent IAS 39 rule is now old hat).

To take an example, suppose with our ‘inception MTM = £5m’ example a year passes and interest rates don’t move; the actual swap is worth roughly £4m and the hypothetical still roughly zero. We would then book the £1m movement in fair value as a credit to ‘finance costs’, representing the unwind of the discounting reflected in the inception MTM. No rates movements; no hedging; so far so good.

But suppose interest rates fall and the swap MTM is instead a negative £4.2m, and let’s say the hypothetical (receive fix) is positive at £0.2m. The accounting will be £0.8m through finance costs with none of the movement treated as ‘hedged’. We have a positive move in MTM of the actual (ie less negative) and a positive move in the hypothetical. There is movement in both but zero ‘effectiveness’, and it is looking a bit off through the lens of FRS 102 chapter 12. The values could have moved in the opposite direction… but they didn’t, even while part of the MTM movement is clearly a consequence of rates movements.

One has two basic approaches here:

(i) Stick with the old method: maintain that the transaction is a sensible piece of risk management and the accounting works most of the time and is relatively straightforward.

(ii) Come up with a more nuanced approach and strip out ‘interest rate-related’ (ie ‘hedged’) movements in MTM from everything else, giving yourself something to book against CFHR, as expected, when rates move.

There are several alternatives to applying (ii), and we have a favourite (modelling the swap valuations using the inception date yield curve and using that to figure out what goes where), but this year is the first we have seen a real focus on this particular wrinkle. This is a consequence of the interaction between market practice at particular points in time/typical swap tenors/movements of rates in recent years, and there is not a market consensus regarding documentation and reporting.

There is no point aspiring in one article to capture every hedge accounting point of change or discussion, and I don’t have space here to return to the question of documentation more fully. However, the general take on my and my colleagues’ part is that the interaction between hedge accounting methodologies and financial reporting, including in some cases as regards financial covenants, is at risk of being neglected. The consequent risk is that finance teams and boards can end up facing what seem like quite significant reporting decisions under time pressure.

Jonathan Clarke, managing director, Centrus

RELATED