What should HAs consider when looking to overseas investors?

Each market has specific characteristics depending on where you decide to look for funding, writes Maria Goroh of Centrus.

When considering institutional investor funding, international markets should be taken into account by larger borrowers with the relevant treasury resources to manage more complex processes, ongoing monitoring and appropriate risk management.

Tapping new investors engenders increased competition and access to wider capital pools for borrowers. Thanks to increased awareness of the housing sector among overseas investors, which stems from education about the sector, we’ve seen an increasing number of transactions involving non-UK funders.

Unsurprisingly, large pools of capital potentially interested in social housing are based in other developed financial markets such as the US, Europe, the Nordics, Japan, Hong Kong and Korea. Each of these markets has its own characteristics and preferred formats in which institutions (largely insurance companies, pension funds and asset managers) prefer to invest.

Attractions of the US market

The largest international capital market is the US. It is well established and deep, dating back to the 1990s. The US private placement (USPP) market is also the largest alternative funding market for UK housing associations (HAs).

Over the past couple of years, HA borrowings from the USPP market amounted to more than a couple of billion pounds, and this continues to grow. US investors are attracted by regulation, stability, the strong ratings of HAs and, to a lesser extent, the secured nature of obligations.

The USPP market’s scale, low exposure to the UK HA sector and capacity mean that it provides a good alternative to the domestic UK market where some native institutions have very high exposures; M&G Investments alone has almost £5bn of HA debt across public and private paper. Sanctuary was one of the first HAs to issue a USPP and has borrowed more than $400m from US investors, with the most recent unsecured issue in March last year.

Other UK HAs accessing the USPP market in recent years include Vivid, Newlon, Network Homes, Octavia, Stonewater and Bromford. Large borrowers such as Peabody, Circle (now Clarion), Orbit and Places for People have also previously accessed the US market.

The main attractions of the USPP market are its large investor base along with interest in the sector, competitive pricing, large ticket sizes, and options for bilateral or ‘club’ deals. The UK market has primarily evolved around bilateral deals only.

USPP documentation is similar to a UK note purchase agreement, apart from US representations and cross-currency swap break language, which is required by most US investors.

Issuers receive funding in pound sterling and most investors execute the swap on their side but require a swap break cost indemnity in the event of optional prepayment by the borrower.

Borrowers may choose to fund in US dollars and swap the currency themselves. However, in most cases, UK borrowers across different sectors will prefer the US investors to hold the swap.

Covenants tend to include asset cover with interest cover and sometimes a gearing covenant. The exact suite will depend on the credit quality and size of the borrower.

US investors are willing to provide unsecured funding as well, and are more amenable to this format than their institutional counterparts in the UK. We have seen some borrowers accessing the market with secured and unsecured tranches and the premium for unsecured tends to range between 30 and 50 basis points depending on market conditions and credit quality. The USPP market tends to prefer medium-dated maturities ranging from 15 to 25 years, with a maximum term of 35 years.

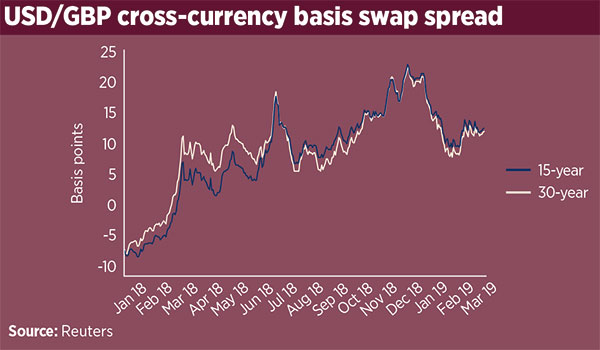

From a relative value perspective, the competitiveness of US investors depends on spread levels for similarly rated domestic issuers in the US, general credit perception, appetite, and the cross-currency basis swap.

The impact of cross-currency basis has deteriorated since early 2018 due to movements in the GBP/USD exchange rate. However, we still see UK issuers entering the US market as credit perception and general appetite still provide scope for investors to provide tight spreads.

Asia and Europe

Beyond the US market there has been interest in the UK housing sector from other regions, driven mainly by the highly rated nature of the sector for Asia and the environmental, social and governance (ESG) investment angle for Europe and the Nordics. These markets have a less established track record but we are seeing rising appetite from investors based in Korea, Japan, Hong Kong, Europe and Norway.

Korean insurers provide funding in pound sterling and in most cases don’t require swap break cost language. Preferred documentation tends to be a listed medium-term note, but loan/PP formats can also be used. Less value is assigned to security as Asian investors value a wider spread over security. We’ve seen pricing competitive or in line with UK markets at ticket sizes of around £100m to £150m per name from Korean investors.

“We are seeing rising appetite from investors based in Korea, Japan, Hong Kong and Europe”

Japanese investors are less active and require the issuer to do the swap. They can, however, be very competitive for unsecured funding provided the issuer does the swap (Notting Hill and Places for People have accessed the Japanese market in the past in smaller sizes of circa £50m per transaction). Asian investors provide shorter tenors – up to 20 years for Korea and 12 to 15 for Japan.

The Hong Kong market is similar to Japan in terms of demand and number of transactions.

We are seeing some investor demand from Europe – mainly Germany and Benelux – and Norway. Unlike the US, European investors typically don’t do cross-currency swaps themselves and require issuers to swap. There have not been many transactions in euros, with only Places for People accessing that market to date. However we expect issuance in euros to pick up as we see increased interest from investors in the sector driven by ESG targets.

With the UK HA market becoming a more internationally recognised asset class and borrowers increasingly sophisticated in accessing these markets, we expect activity with international investors to grow, providing healthy competition for domestic institutions.

Maria Goroh, director, Centrus

RELATED