BME build scheme opened to small HAs

Large association extends BME offer to other London HAs as part of 100,000-home delivery plan. Sarah Williams reports

L&Q has thrown open its offer of building homes in partnership with black and minority ethnic (BME) associations to all small providers in London, engaging with 22 to date, while helping to forge new funding relationships.

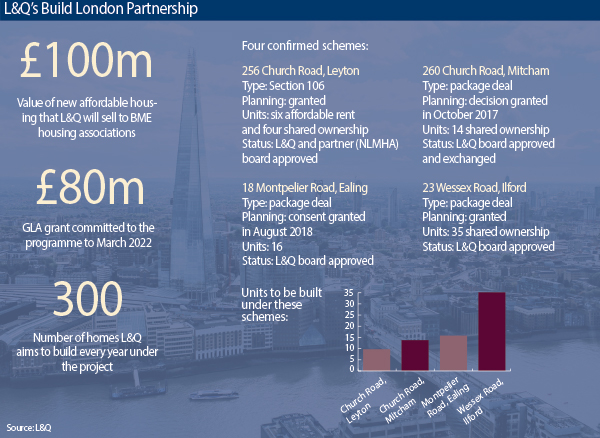

The 93,000-home, London-based association announced in July that it will deliver and sell £100m of new affordable housing at cost value to nine small BME housing associations in London, as part

of its ambition to deliver 100,000 new homes over 10 years.

The Build London Partnership, formerly known as the BME Nine initiative, involves the provider engaging with small housing associations (HAs) with growth ambitions, and acquiring and developing small sites on their behalf. After discussions and a launch within BME London (a member group of 14 BME-led HAs), L&Q has now engaged 22 partners with the programme, and has reviewed opportunities across 28 London boroughs.

L&Q has now approved four schemes – totalling 75 homes – and construction work on the first site is due to start this year.

The schemes are being funded by a revolving investment of £100m from the L&Q Foundation, along with grant from the Greater London Authority (GLA), focused on “genuinely affordable” homes.

L&Q helps to find the sites, and then undertakes feasibility studies and financial modelling, before using its balance sheet and development teams to deliver the site on behalf of the partner HA. After completion, the housing association in question can acquire the site at cost price.

L&Q plans to build around 300 of these homes per year, aiming to complete 1,000 by 2024, with the help of the partner associations.

While the initiative is targeted at schemes below 50 units, sites of 30 and under is a more realistic categorisation, regional director Vicky Savage explains. The biggest scheme is currently 35 units, but the other three are considerably smaller – at 10, 14 and 16 units.

Bringing the project into L&Q has meant establishing a dedicated team to engage both housing associations and the property market for smaller sites. This is led by Abi Jacobs, head of strategic partnerships.

Ms Savage says: “You wouldn’t necessarily bring a sub-30 unit to L&Q; that wouldn’t really have been our business, so Abi has had to engage with all the land agents and players to explain to them about this project.”

Rather than a formal joint venture, a memorandum of understanding is signed at the beginning of the process, but L&Q carries all development risk, and there is no legal obligation to buy the completed scheme at the end of the process.

Building trust

Part of the challenge has been convincing associations of L&Q’s motivation – the desire to deliver genuine additionality of stock by supporting smaller organisations to grow, as opposed to a veiled takeover bid or a money-making exercise.

Ms Savage says: “The big issue that we’ve been faced with is gaining the trust of these organisations. L&Q is a huge organisation and we are often faced with the question, ‘What’s in it for L&Q, why are you doing this?’ And we are doing it because we absolutely believe it is the right thing to do to unlock these small sites and to upskill these small housing associations.”

1,000

Total number of homes L&Q and small HAs aim to build by 2024

Trusting L&Q also means trusting its product, says Waqar Ahmed, group director of finance. L&Q will bring its development expertise and the economies of scale of a larger organisation, but that means adhering to its own established design and build standards, without being able to offer flexibility on smaller details.

He tells Social Housing: “That sounds slightly assertive from L&Q, but you must remember that when it comes to small sites, you have to make decisions very quickly – we’re not going to consult on the types of entry phone systems we put in or the types of balconies.”

He adds: “It is an L&Q product, built for L&Q, designed for L&Q, using L&Q’s procurement advantage and L&Q’s borrowing rates to fund the development scheme. At completion, those associations can have it at cost if they want it, and if not, no hard feelings.”

Creating an “L&Q product” also means that, in the event that the initial housing association does not want to buy the completed scheme, and no other smaller association wants to take it on (a scenario Mr Ahmed deems unlikely), the scheme can easily be absorbed into the L&Q portfolio.

However, this would represent failure of a kind. Ms Savage says: “Success is passing these homes to the small housing associations.

“If we get to the end of the process and nobody wants them, or they don’t feel competent enough to take these into management, then I would say that we’ve failed in our objective.”

Alongside developing the schemes for partner organisations, L&Q is setting out to provide the training, mentorship and advice that will in time enable associations to take on more of their own development schemes. Chief executives and finance directors can attend seminars at L&Q, or shadow development teams in appraisals.

Ms Jacobs says: “We’re not just helping them in their growth aspirations, we’re also helping them with softer skills, and upskilling their senior executives by doing workshops.”

A previous scheme that was initiated in late 2013 and based on a match-funding concept, the ‘G320 offer’, would have seen L&Q and a partner small housing association invest 50/50 in a scheme, before splitting the properties at the end, some of which would be sold to cross-subsidise the development. This was scrapped after it was found to be overly complicated, Mr Ahmed says, and associations were unwilling to share the sales risk.

Likewise, another shelved initiative – the Untapped Sites Initiative – would have seen L&Q acquire and develop sites and offer them at completion to the associations. “But the problem with that approach is it’s hit and miss, and because we weren’t actually preparing them for those sites, smaller associations don’t have the cash – so we weren’t prepared to wait six months for them to get the funding.”

Scheme partners

L&Q has now engaged 22 housing associations with the programme, including:

- Penge Churches

- Inquilab

- Tamil

- Industrial Dwellings Society

- Peter Bedford

- Millat Asian

- Bangla

- Shian

- North London Muslim

Funding partners

Through the Build London scheme, L&Q has introduced partner organisations to funders who could potentially back them in acquiring the sites.

“Those funders are not funding L&Q, there is no underwrite from us, no guarantees, but they’re really keen to give long-term finance to those associations for these assets because they know that L&Q has done most of the due diligence on the schemes,” Mr Ahmed says.

Aziz Rahim, chief executive of North London Muslims Housing Association (NLMHA) – whose 10-unit Church Road scheme in Waltham Forest is currently in line to become the first in the initiative

to complete in June 2020 – says that the L&Q connection means better lending terms for smaller housing associations.

“Without this partnership, they don’t offer us the same sort of interest rate… when they see that L&Q is handling the scheme, their confidence increases.”

Church Road is a Section 106 project, in which L&Q is not directly developing the units but is acting as the development association in appraising and evaluating its delivery in collaboration with NLMHA.

Mr Rahim says: “[L&Q] carry out their appraisal, go through the risk maps, [they say] we will be the developing housing association and we will deliver to you on completion. So they’re taking that huge responsibility and all the risk in dealing with the developer – so it’s a very easy transaction for us.”

L&Q will also help to sell the four shared ownership properties on the site, as it is doing on another site in development with NLMHA, Leven Wharf, which pre-dates the Build London programme.

Mr Rahim says: “[L&Q] are ideal partners because they don’t touch under 50 units – mainly they go for over 100 – whereas smaller housing associations always look for smaller schemes.”

This, he says, means that unlike some collaborative partnerships between housing associations – such as the North River Alliance led by Islington & Shoreditch Housing Association, in which NLMHA is also involved – there is no chance of the two associations competing for the same site.

And while, as at Church Road, Section 106 will make up some of the projects, Ms Jacobs emphasises that L&Q is concentrating on smaller development opportunities such as infill sites – “sites that people just don’t think would be any use, but actually we could do something great with”.

This is part of an overarching aim by L&Q to deliver “genuine additionality” – which applies as much in its work with small housing associations in London as it does in its efforts to continue to expand regionally.

Mr Ahmed says: “We are not in competition with anyone – if you can build without L&Q then build without L&Q.”

Apart from an overhead for the cost of the team, and interest on the funding at L&Q’s internal borrowing rates, providers purchase the schemes at cost.

The £100m pot comes from a £250m gift that L&Q put into its community investment arm: the L&Q Foundation, set up in January last year. The foundation has also invested £10m into St Mungo’s Real Lettings Property Fund to help secure accommodation opportunities for homeless people in London.

As with all of L&Q’s development projects, schemes within the Build London Partnership incur interest on peak debt, calculated monthly, using a low interest rate based on the average group borrowing cost. The foundation benefits from being credited this interest, but channelling money through the foundation does come at a cost.

Referring to the £250m placed into the foundation, Mr Ahmed says: “If that [money] was invested, the returns that we would expect that investment to generate is about four per cent per annum – the equivalent of spending about £10m a year.”

Asked about incentives, he adds: “There is no tax perspective here as there is no profit being made.”

Economy of scale

For Clare Norton, head of the G320 group of London housing associations, the Build London programme’s aim to create 1,000 affordable new home starts by 2022 is “very ambitious, but definitely possible”.

The G320 is not involved in an official capacity in the scheme, but L&Q has “been careful to work with the G320, and engage with our members and listen to what we’re looking for, and then to develop their programme as they get that feedback”, she says.

Ms Norton’s own organisation, Peter Bedford Housing Association, is signed up as a partner, although she expects the scheme to take place towards the end of that target period, with Peter Bedford first prioritising opportunities to extend and augment its existing properties.

Alongside the bespoke team L&Q has assembled, Ms Norton sees the scheme’s efforts to establish a “small contractors framework” as advantageous. Currently 27 small and medium-sized contractors are engaged in an £8m framework to deliver the programme.

“[One of the issues] for small housing associations is that you can’t get contractors, large contractors, to work for the same standards and levels and be interested in the framework.”

This is particularly important on small sites, which are “inherently more difficult to develop”, Ms Norton says. “Quite often there are going to be difficulties around utilities or transport being very close, or you might have difficulties as it’s a site that’s encroached upon by other buildings.”

It’s a challenge and opportunity recognised and reflected in the preferential grant rates offered by the GLA, which has currently committed £80m to the programme to 2022.

“Because small associations have become increasingly active around our potential to develop and explaining what the barriers are, I think the GLA has been listening to us and one of the key parts of the London strategy is around developing small sites so in order to make that happen the GLA know it needs to invest in small builders – because the larger ones are not going to be so interested in the sites,” says Ms Norton.

She sees the Build London initiative as one of a number of pathways available to G320 members – who are keen to work with other partners, too.

“It’s a great opportunity, and one element of what we may be able to do to develop housing, but it’s one tool hopefully within a suite of other tools as well.”

This includes schemes such as the North River Alliance, but also – Ms Norton hopes – partnerships with other larger housing associations in time, as well as more collaborative ways of working with smaller HAs on development strategy.

RELATED