Making an impact: what the rise of ESG investment means for social housing

From green bonds to sustainability-linked loans, Sarah Williams looks into the impact investment seeking the ‘social’ in housing

Housing associations (HAs) have an opportunity to reach a “broader universe” of investors amid a global movement towards social and sustainable credentials, according to sector funders and advisors.

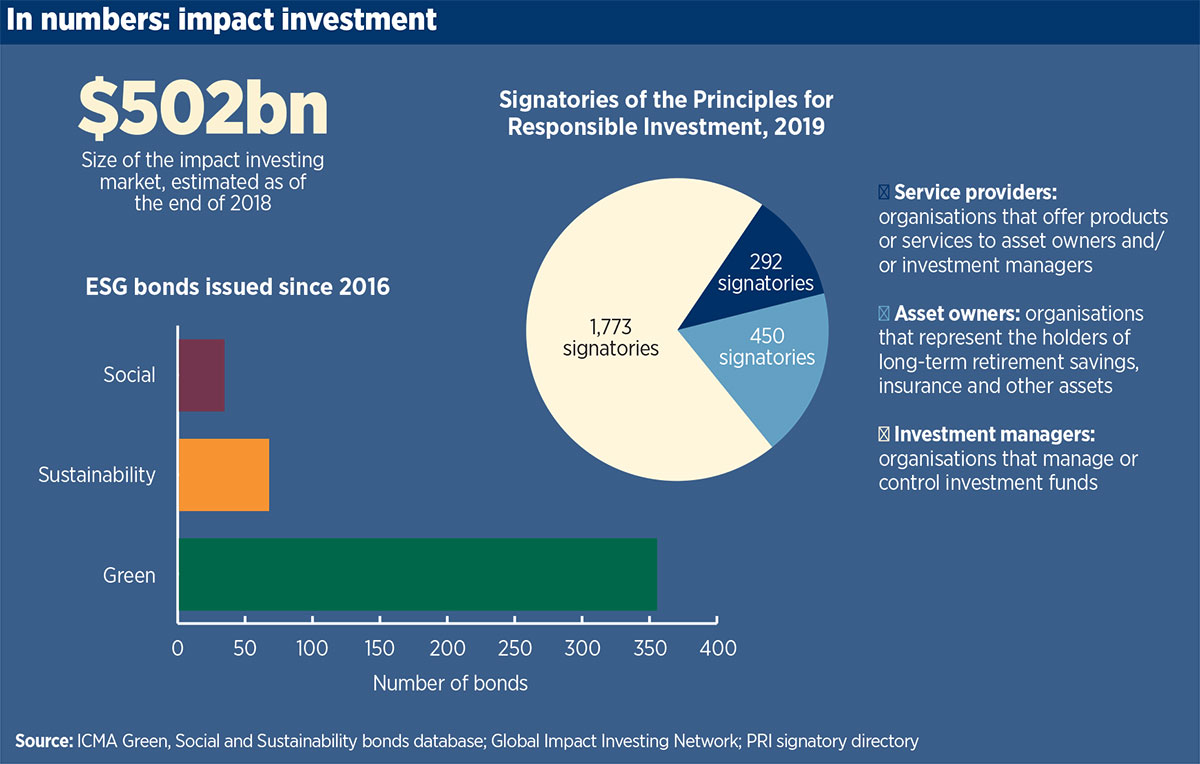

In addition to recent sustainability-linked bank loans, registered providers and finance professionals have flagged a growing focus on environmental, social and governance (ESG) factors from investors this year, at a time when the Global Impact Investing Network estimates that the impact investing market has ballooned to more than $502bn.

Kirsty Garrett, associate director, corporate DCM at Lloyds Commercial Banking, told Social Housing that in both deal and non-deal roadshows the bank had encountered “a growing number of questions from investors around ESG and what the housing association strategy is around ESG”.

A recent survey of global investors by new sector entrant BNP Paribas found that 90 per cent of respondents were predicting that “more than a quarter of their funds would be allocated towards ESG by 2021”.

European investors and issuers are leading the charge on ESG in the bond markets, according to sector bookrunners, with some also noting strong appetite from Asia Pacific investors, compared with less focus from North American investors.

However, upcoming changes to pensions trustee reporting from October, introduced by the Department for Work and Pensions, could see ESG take on new significance for UK pension funds.

According to Dominic Brindley, head of public sector financing and risk solutions at NatWest Markets, the adoption of ESG wrappers – such as ‘green’ or ‘social’ labels – on bonds could enable HAs to diversify their investor base.

“[It] gives access to investors with a specific ESG or ethical mandate as well as those impact investing in green bond portfolio investments that previously may or may not have been interested [in HAs],” he said.

Impact investing

Alongside the focus on ESG is the rise of impact investing across the financial markets with the support of central governments, including through the UK government’s Inclusive Economy Unit in the Department for Digital, Culture, Media & Sport (DCMS).

Jamie Broderick, an impact investment advocate involved in a UK government-commissioned taskforce, told Social Housing: “The reason social housing is so interesting as an impact investment is that it is one of the few areas where it attracts large amounts of market capital doing things that are quite clearly socially beneficial.”

The former UBS head of wealth management in the UK led on a response to the government’s Social Housing Green Paper by the independent ‘Implementation Taskforce’ last year (now the Impact Investing Institute), appointed by the DCMS in March 2018 to progress a series of actions cultivating social impact investment in the UK.

Mr Broderick said: “We’ve now crystallised our interest as a society in social investment, sustainable investment, so now there’s a way to bring [the] good work [of HAs] to the attention of people through these new labels and categories.”

The opportunity includes indications that social bonds could help social housing “start to attract a broader universe of people who are interested in sustainable investment”, he said, as well as the potential to pour equity into the sector, in the face of diminished capital grant funding.

But current barriers to equity include HA discomfort with some existing financial vehicles such as real estate investment trusts, Mr Broderick said, with a need to design new structures.

Big Society Capital – a social investment institution established by the Cabinet Office that has already invested with the likes of CBRE and Cheyne – has suggested that the sector could attract “billions of pounds of risk capital” each year.

Anna Shiel, head of origination at Big Society Capital, told Social Housing: “By risk capital, we mean capital that shares some of the risk with housing providers – ie is more equity-like in nature.”

Pricing impacts

Continued growth in investor appetite comes a year on from the International Capital Market Association’s (ICMA) update to its ‘green’, ‘social’ and ‘sustainability’ bond principles, and the publication by the Loan Market Association (LMA) of its own green and sustainable loan principles.

In February, sector aggregator MORhomes became the first UK corporate to adopt the ICMA Social Bond Principles (SBP), with its debut £250m issuance.

Within UK housing, the issuance was only the second to adopt ESG principles, following the ‘green’ labelled bond of Cross Keys Homes in 2014.

The sector has not yet seen a ‘sustainability’ bond (which fuses GBP and SBP) but UK issuers to use the label have included utilities company Yorkshire Water and retailer Co-op. In the US, coffee chain Starbucks issued its third sustainability bond in May, raising $1bn.

Patrick Symington, chief executive of MORhomes, told Social Housing that HAs could be “missing a trick” in not adopting the social label, adding that “at least one ethical investor” had entered the sector through MORhomes’ issuance “because it is a social bond”.

Questions remain, however, over whether adoption of the label brings any pricing benefit to issuers, given that investors may already have priced HAs’ social value into bids on sector issuances.

“The irony here is that Starbucks might benefit from lower pricing with a sustainability bond, but a social housing provider might not be able to,” said Eleanor James, partner at legal firm Trowers & Hamlins.

Grant Vaughan, partner at Newbridge Advisors, which recently looked into the costs and potential pricing impact of ESG labels for a G15 HA, said that the research found no “immediate obvious pricing benefits” where UK investors were concerned, except enabling pricing pressure where liquidity grew significantly.

But he added: “To the extent UK HAs start to look to Europe for funding, I think [ESG labels could be] a very useful tool to help them get interest from European investors when they are conducting their marketing and execution processes.”

Ms Garrett of Lloyds added: “[You] may find increased liquidity – that some investors could offer a slightly larger bid for a transaction if they have ESG funds that they’d like to invest from.”

NatWest’s Mr Brindley said that in some cases, green bonds had been seen to out-perform non-green bonds in the secondary markets.

He pointed to recent NatWest analysis that compared the full curve of the largest and most recent corporate green bond issuers versus non-green bond issuer counterparts, and found a ‘halo effect’ of between one and 12 basis points (bps), and on average five bps. It attributed this in part to the attraction of a “broader, sustainability-focused investor base”.

Mr Symington said that it was impossible to say whether the MORhomes label had a pricing implication. The aggregator’s maiden issuance priced well above its previously stated ambitions.

But he added that MORhomes had taken the view that the cost of producing the policy, applying the principles and gaining second-party option from agency Sustainalytics was worthwhile.

Fear of missing out

Others have suggested that rather than a pricing benefit, the adoption of ESG could help to future-proof issuers, with those perceived to be ‘laggards’ in adopting the metrics eventually missing out on the best deals.

Phil Jenkins, managing director at Centrus, said: “I think that wrappers are the natural evolution from where we are. But rather than it being [a case of] ‘you’re going to get a pricing benefit to doing it’, it’s almost that – if you’re going to do deals – you’re going to have to persuade investors that you’re ticking the boxes on this.”

This could feed into efforts of UK pension funds following changes to trustee reporting from October.

Richard Butcher, client director at PTL, who advises on pension scheme governance, said that UK pensions trustees should already have been including ESG as part of identifying long-term financial risks, but that some trustees had ignored ESG elements to date.

“[The new guidance] may increase the desire to invest in ESG-rated businesses – but only if those businesses display the other investment criteria the trustees want.” But he said it was “unlikely” to lead to lower cost funding for HAs.

Liz Cain, senior debt origination manager at the Pension Insurance Corporation (PIC) – which invests predominantly in HA private placements – said that the company had always considered ESG factors in credit assessments, but noted “an increasing market awareness of ESG factors”.

“[Using] ESG can be a tool for investors like PIC to understand some key long-term risks. Social housing providers score well under this analysis and if traditional credit metrics are good too, this allows PIC and other investors to be comfortable lending to the sector in the long term,” she said.

Sustainability-linked loans

In the social housing sector, three HAs have recently signed sustainability-linked loans (SLLs) with banks, which see borrowers receive a more favourable interest rate upon the delivery of pre-agreed social targets.

Peabody became the latest to sign an SLL with BNP Paribas, with metrics linked to childcare qualifications, while L&Q and Optivo both signed loans with incentives linked to employment support. Optivo also signed an SLL with new sector lender First Abu Dhabi Bank.

David Reynolds, senior banker at BNP Paribas, which worked with the LMA to design its SLL principles, said that the products were a “key part of [the bank’s] socially responsible lending strategy”.

“We will always look to structure these loans as SLLs where it makes sense to do so, and where we can align the metrics with the existing strategy of the housing association,” he added.

The footprint of SLL in the sector could also soon spread to more established sector lenders, with two banks telling Social Housing they were eyeing the product.

David Cleary, head of housing at Lloyds Commercial Banking, said that the bank is focused on delivering SLLs inside the next six months.

“We’re looking at that across the housing book. We are well advanced with our thoughts on how we might link the provision of the facilities to the client’s ability to deliver on its sustainability agenda.”

Mr Brindley said that NatWest was “actively looking to help clients fulfil their sustainability agenda”, and part of that included the ability to offer SLLs “where this is mutually agreeable”.

HA perspectives

Tom Paul, director of treasury and commercial at Optivo, said: “It’s in our interests to make sure our debt is as investor-friendly as we can make it. But what I wouldn’t want to do is pay money for [an agency] to tell us that we’re a charity and not have any pricing benefit for it, because that’s just a leaking of value.”

Imran Mubeen, head of treasury at Bromford, said that although they present a new challenge, the ESG metrics could complement a provider’s reporting of existing strategic targets.

“[Naturally] HAs are concerned with the ESG agenda as part of their overall strategy, so it’s about communicating and codifying that in a way that doesn’t distract from the strategy but plays into how investors or funders want to receive data and information.”

Mr Mubeen said that the association was in “very proactive conversations with funders and the investor community” to understand the potential of applying an ESG wrapper to its next bank facility or large bond issue, following marked interest in ESG factors from a number of funders and investors.

“I think it will increase the pool of investors and I think it should have a favourable impact on pricing,” he said. He added that Bromford would always seek to achieve competitive terms and pricing.

Steven Henderson, group director of finance at Scottish association Wheatley Group – which has previously accessed loans linked to ESG factors including the Scottish charitable bonds investment programme, managed by Allia Impact Finance – said that it was investigating the benefit of additional reporting, and would consider SLL products if there was a pricing benefit.

“To date, we have used verification by the European Foundation for Quality Management to externally score our strategy, processes, impact and results.

“We will continue to explore whether adopting one of the many other international ESG-type frameworks could enhance the quality and usefulness of our reporting.”

Don’t miss our special afternoon stream ‘Social housing meets impact investing’ at the Social Housing Annual Conference on 4 December in London

RELATED