Providers continue to bolster revenues with non-social income

Amid falling government grants and the rent cut, housing associations continue to turn to market activity.

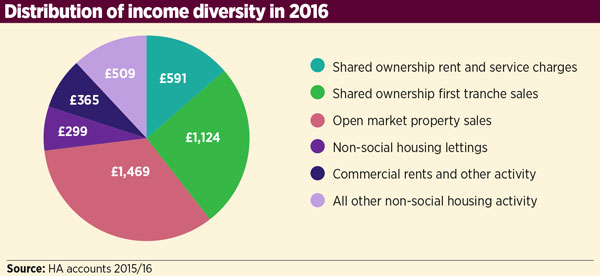

The housing associations most active outside social housing made more than a quarter of their turnover from activities as diverse as home sales, leisure centre management and electricity generation in the 2015/16 financial year.

Social Housing’s analysis of the 120 associations with the largest share of their turnover from activities other than social housing showed that they made 28 per cent of their income from these sources.

The rise of more than 20 per cent in non-social revenue (including shared ownership) outstripped the growth in overall turnover of 9.5 per cent. Income from diversified activities has been rising faster than overall turnover for several years. Associations have moved into areas such as building homes for sale and shared ownership to offset falls in government grants. Additionally, the majority of money in the 2016 grant programme was targeted at homeownership, which is likely to increase the proportion of turnover that comes from sources other than social rent in the future.

The data comes from the 2015/16 audited accounts of these associations. It excludes fixed asset sales and income from staircasing, where occupiers of shared ownership properties buy a bigger stake in their homes.

Associations have moved into areas such as building homes for sale and shared ownership to offset falls in government grants.

Although diversified activities comprised a greater share of total income for the 120 associations, there was little change in the number of associations making more than half of their income from these sources (five in 2016, from six in 2015). But the number that generated more than a third of their income from non-social housing rose to 23 from 19.

Property sales

The biggest source of non-social housing income was open market property sales, which rose by more than 40 per cent to £1.5bn.

Eight associations made more than a fifth of their income from open market property sales. All but one were among the 14 associations that made the largest share of their total revenue from diversified sources. However, open market sale remains a minority activity: 75 of the 120 made no income from outright property sales.

First tranche sales

The next largest source of income was first tranche sales of shared ownership homes, where turnover rose nearly 39 per cent and exceeded £1bn for the first time. All but eight associations made first tranche shared ownership sales in 2016. Three of the eight received rent from shared ownership properties, which indicates that they had made sales in previous years.

The remaining income not from social or affordable rent came from rent on shared ownership properties; non-social lettings such as properties for students and homes rented at market or intermediate rates; commercial rents including garages, shops, investment properties and offices; and other income including revenue from joint ventures, care homes, solar panels, gas servicing and sewerage services. Management services, training, regeneration, community services and leasehold management are also included in non-social housing income.

Commercial rents and other income

The biggest percentage rise in turnover – of almost 45 per cent – came from commercial rents and other activity, although this was a comparatively small sum in absolute terms since it provides one of the lowest incomes of the various types of non-social housing.

The ‘other income’ side of this category generated the most revenue and saw the largest rise. It includes care, property investment and solar panels. Income from care was a mixed picture, with some associations experiencing increases and others seeing drops.

Sanctuary increased its revenue from care and domiciliary care. The association won a number of new contracts in the year, including taking over management of five care homes in Westminster and a new contract with George Eliot Hospital NHS Trust to provide 16 intermediate care beds in the hospital in Nuneaton. The association is the only one in the top 20 to use the EU IFRS accounting standard rather than FRS 102.

The two associations that listed income from solar panels saw small falls in this revenue in 2016. The government cut the feed-in tariff, an incentive payment for generating electricity, at the start of the 2015/16 financial year.

Habinteg, which saw its income from solar panels fall from £1.21m to £1.15m, said in its accounts that more than 1,200 of its properties had solar panels in order to lower fuel bills for residents and provide income for the association. However, the cut to the tariff meant it did not expand its solar panel programme in 2015/16.

Affinity Sutton saw a large rise in its income from joint ventures, which is included in the other income aspect of this category. These were its developments of 72 Farm Lane and 261 City Road with Mount Anvil and Graylingwell with Galliford Try. Income from development joint ventures tends to fluctuate from year to year as schemes go through various stages of development and sale.

Summary of accounts: 120 HAs with the most diverse incomes

| Social housing activity | 2015/16, £ | 2014/15, £ | Change | Share of total turnover | |

|---|---|---|---|---|---|

| 2015/16 | 2014/15 | ||||

| Shared ownership rent and service charges | 591 | 526 | +12.4% | 3.8% | 3.7% |

| Shared ownership first tranche sales | 1,124 | 811 | +38.6% | 7.2% | 5.7% |

| Non-social housing activity | |||||

| Open market property sales | 1,469 | 1,047 | +40.3% | 9.4% | 7.4% |

| Non-social housing lettings | 299 | 285 | +4.9% | 1.9% | 2% |

| Commercial rents and other activity | 365 | 252 | +44.7% | 2.3% | 1.8% |

| All other non-social housing activity | 509 | 660 | -22.8% | 3.3% | 4.6% |

| Total | 4,358 | 3,581 | +21.7% | 28% | 25.2% |

| Total turnover | 15,555 | 14,208 | +9.5% | ||

Note: Totals may be affected by rounding Source: HA accounts 2015/16

Non-social lettings

Income from non-social housing lettings, including student accommodation and properties let at intermediate and market rents, rose by 4.9 per cent to nearly £300m. L&Q had a notable rise in non-social lettings income, driven by an increase in market renting revenue. Six other associations saw their income from non-social rents rise by more than £1m in 2016. Four saw their income from this source reduce by more than £1m.

Other non-social activity

Other non-social activity, which is mostly management and community services, fell by nearly 23 per cent.

However, this figure conceals some dramatic rises for individual associations. Places for People’s business managing leisure centres made £13.4m more in 2016 than the previous year. It said the rise was due to an increase in sales and winning four new contracts. Leisure centre management made up 40 per cent of the group’s income from non-social housing work.

Variety of turnover: 120 HAs with the most diverse incomes

| Number of units | Total turnover £m | Social housing activity % | Non-social housing activity % | All other non-SH % | Total SO rent, first tranche and non-SH income: share of total turnover % | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Shared ownership rent | Shared ownership first tranche | Open market and property sales | Non-SH lettings | Commerical rents and other activity | 15/16 | 14/15 | ||||

| Brunelcare | 1,450 | 33.2 | 0.29 | 0 | 0 | 0 | 39.44 | 35.55 | 75.28 | 75.15 |

| Network | 20,560 | 311.01 | 2.76 | 19.19 | 34.03 | 0.56 | 0.47 | 0.52 | 57.53 | 34.58 |

| Catalyst | 21,060 | 227.4 | 9.89 | 9.75 | 30.7 | 0 | 1.95 | 1.91 | 54.21 | 51.78 |

| Peabody | 29,010 | 351.98 | 1.9 | 13.41 | 28.57 | 2.61 | 4.9 | 2.18 | 53.58 | 32.48 |

| One | 15,590 | 244.95 | 6.23 | 8.15 | 34.94 | 1.38 | 2.36 | 0.47 | 53.55 | 50.95 |

| Places for People (a) | 152,780 | 616.58 | 0 | 0.43 | 16.02 | 5.81 | 0 | 30.72 | 52.97 | 46.76 |

| Notting Hill | 31,740 | 415.4 | 7.44 | 18.25 | 17.48 | 4.36 | 1.04 | 3.61 | 52.17 | 52.53 |

| A2 Dominion | 36,130 | 378.4 | 6.71 | 6.9 | 30.02 | 4.52 | 0 | 0.21 | 48.36 | 40.54 |

| Orwell* | 3,720 | 45.64 | 0.72 | 0.59 | 0 | 0 | 0 | 45.34 | 46.64 | 52.12 |

| L&Q | 73,070 | 720 | 4.86 | 8.06 | 29.31 | 3.06 | 0.28 | 0.42 | 45.97 | 56.18 |

| Genesis | 32,320 | 406.4 | 6.64 | 4.7 | 14.35 | 1.72 | 0 | 17.86 | 45.28 | 39.07 |

| Thames Valley | 15,210 | 104.04 | 21.20 | 20.62 | 0 | 2.10 | 0 | 1.35 | 45.27 | 37.71 |

| Equity | 4,710 | 25.17 | 14.3 | 24.43 | 0 | 3.05 | 0.75 | 0 | 42.53 | 25.27 |

| Origin | 6,570 | 74.53 | 2.92 | 7.34 | 26.47 | 1.61 | 2.99 | 0 | 41.33 | 20.57 |

| Swan | 10,950 | 109.92 | 1.95 | 0.95 | 38.35 | 0 | 0 | 0 | 41.24 | 26.64 |

| Accord | 12,640 | 120.14 | 1.9 | 2.46 | 0 | 0.09 | 0 | 36.43 | 40.88 | 44.31 |

| ISHA | 2,220 | 27.45 | 7.16 | 27.03 | 0 | 1.16 | 3.34 | 0 | 38.69 | 45.92 |

| Moat | 20,620 | 120.73 | 15.2 | 20.77 | 0 | 0.16 | 0 | 0.38 | 36.52 | 35.1 |

| Housing & Care 21 (a) | 19,500 | 219.68 | 0 | 8.43 | 0 | 0 | 0 | 27.92 | 36.35 | 36.83 |

| East Thames | 15,000 | 128.72 | 9.46 | 22.14 | 1.17 | 0 | 0 | 2.60 | 35.37 | 42.81 |

| North Hertfordshire | 9,070 | 83.98 | 1.04 | 2.29 | 0 | 0 | 0 | 31.79 | 35.12 | 21.3 |

| Octavia | 4,790 | 49.97 | 4.76 | 21.54 | 0 | 0.27 | 1.43 | 6.44 | 34.44 | 27.79 |

| Sanctuary*** | 100,160 | 669 | 0.85 | 4.22 | 0 | 9.52 | 19.16 | 0.51 | 34.26 | 33.1 |

| Gentoo Housing | 34,090 | 215.33 | 0.12 | 0.1 | 16.73 | 0 | 0 | 17.01 | 33.96 | 44.08 |

| Joseph Rowntree* | 2,500 | 22.01 | 8.98 | 8.9 | 0 | 0 | 14.82 | 0 | 32.71 | 27.9 |

| Hyde | 48,210 | 350.52 | 4.45 | 9.32 | 17.07 | 0 | 0 | 0.48 | 31.31 | 29.75 |

| Plus Dane | 18,770 | 97.31 | 1.82 | 2.94 | 0 | 0.72 | 5.94 | 19.78 | 31.20 | 38.39 |

| Black Country | 2,080 | 15.96 | 2.34 | 4.03 | 0 | 0 | 6.51 | 17.60 | 30.48 | 29.01 |

| Paradigm | 14,090 | 115.28 | 5.3 | 21.8 | 0 | 3.04 | 0 | 0 | 30.14 | 25.44 |

| Guinness | 60,670 | 426.1 | 4.34 | 4.76 | 19.46 | 0 | 0 | 0.35 | 28.91 | 19.13 |

| Family Mosaic | 25,390 | 265.64 | 4.07 | 6.82 | 15.87 | 0 | 0.35 | 0 | 27.11 | 20.32 |

| Green Square | 12,000 | 83.83 | 2.43 | 3.62 | 16.7 | 0.52 | 3.6 | 0.18 | 27.04 | 27.33 |

| Acis | 6,730 | 31.36 | 2.76 | 5.17 | 0 | 16.07 | 0 | 2.45 | 26.44 | 26.79 |

| Newlon | 8,010 | 84.71 | 8.55 | 17.1 | 0 | 0 | 0 | 0 | 25.65 | 18.47 |

| Aldwyck | 10,530 | 70.09 | 4.8 | 6.47 | 9.03 | 1.58 | 0 | 3.19 | 25.07 | 19.63 |

| Hastoe | 7,390 | 33.61 | 7.14 | 11.86 | 0 | 2.39 | 0 | 3.55 | 24.94 | 28.06 |

| Luminus | 7,320 | 44.7 | 1.79 | 4.46 | 2.09 | 0 | 0 | 16.52 | 24.86 | 27.95 |

| Sentinel | 9,860 | 71.72 | 4.09 | 18.11 | 0 | 1.77 | 0 | 0.65 | 24.62 | 24.77 |

| Estuary | 4,320 | 38.89 | 3 | 10.92 | 0 | 10.13 | 0 | 0.35 | 24.4 | 20.89 |

| Town and Country | 9,180 | 70.69 | 2.69 | 10.19 | 9.08 | 1.74 | 0 | 0.41 | 24.11 | 27.21 |

| DCH | 22,840 | 130.99 | 4.89 | 8.31 | 8.73 | 1.05 | 0 | 0.25 | 23.23 | 23.82 |

| Spectrum (a) | 16,380 | 118.61 | 0 | 6.07 | 0 | 0 | 0 | 16.67 | 22.74 | 18.32 |

| Hightown | 5,080 | 50.69 | 6.01 | 15.19 | 0 | 0 | 1.08 | 0.24 | 22.52 | 21.78 |

| Hexagon | 4,180 | 34.77 | 4.5 | 12.4 | 0 | 0 | 5.35 | 0 | 22.25 | 21.05 |

| Paragon | 9,130 | 70.67 | 5.72 | 16.21 | 0 | 0 | 0 | 0.18 | 22.1 | 20.68 |

| Viridian | 15,990 | 138.01 | 3.01 | 6.19 | 2.46 | 9.93 | 0.19 | 0 | 21.78 | 20.39 |

| Waterloo | 20,430 | 104.58 | 9.07 | 9.94 | 2.58 | 0 | 0 | 0 | 21.59 | 20.52 |

| Metropolitan | 37,830 | 234.9 | 9.66 | 5.2 | 0.19 | 1.91 | 2.87 | 1.59 | 21.43 | 21.86 |

| Affinity Sutton | 59,470 | 386.42 | 3.01 | 9.71 | 6.86 | 0.3 | 31.08 | -29.7 | 21.26 | 29.14 |

| BPHA | 17,900 | 123.09 | 4.67 | 13.22 | 0 | 0 | 0 | 3.37 | 21.26 | 22.6 |

| First Wessex | 19,190 | 126.11 | 4 | 8.32 | 2.75 | 4.23 | 0 | 1.68 | 20.98 | 15.93 |

| Yarlington | 10,140 | 61.56 | 2.46 | 14.71 | 0 | 0 | 0 | 3.69 | 20.87 | 14.44 |

| Southern | 27,220 | 177.51 | 9.4 | 5.64 | 4.01 | 0.35 | 0.97 | 0.33 | 20.7 | 24.56 |

| Derwent Living* | 9,090 | 68.86 | 7.43 | 5.72 | 0 | 7 | 0 | 0 | 20.15 | 22.5 |

| Radian | 24,550 | 143.16 | 3.4 | 5.26 | 0 | 1.35 | 0 | 9.98 | 19.98 | 22.03 |

| Longhurst | 18,890 | 112.91 | 2.96 | 13.21 | 2.38 | 0.3 | 0 | 1.02 | 19.86 | 17.54 |

| Wandle | 7,180 | 56.68 | 5.75 | 8.97 | 4.2 | 0.11 | 0.65 | 0 | 19.68 | 17.53 |

| Staffordshire | 3,250 | 22.76 | 1.47 | 8.31 | 0 | 0 | 0 | 9.83 | 19.6 | 10.6 |

| Great Places | 18,410 | 103.92 | 4.09 | 8.18 | 5.86 | 0.94 | 0 | 0 | 19.07 | 9.23 |

| Circle Anglia | 64,950 | 439.2 | 4.08 | 4.33 | 5.31 | 3.55 | 0 | 1.02 | 18.28 | 17.24 |

| Knightstone | 11,410 | 73.56 | 4.73 | 8.37 | 4.58 | 0.52 | 0 | 0 | 18.19 | 11.99 |

| Central & Cecil | 2,290 | 25.3 | 0 | 0 | 0 | 0 | 15.63 | 2.27 | 17.9 | 12.88 |

| Aspire (a) | 9,260 | 41.31 | 0 | 2.31 | 0 | 2.3 | 12.84 | 0.16 | 17.62 | 16.79 |

| Asra | 14,140 | 90.19 | 2.94 | 8.33 | 0 | 1.35 | 0 | 4.9 | 17.52 | 16.15 |

| Cross Keys Homes | 10,600 | 60.5 | 1.78 | 10.68 | 0 | 0 | 0 | 4.42 | 16.88 | 10.97 |

| Anchor Trust | 28,320 | 367.33 | 0 | 0 | 15.17 | 0 | 0.25 | 1.24 | 16.66 | 1.61 |

| Sovereign | 38,370 | 234.72 | 4.92 | 9.12 | 0 | 2.6 | 0 | 0 | 16.64 | 16.66 |

| Westward | 7,300 | 41.59 | 6.3 | 4.72 | 0 | 0.07 | 0 | 5.48 | 16.57 | 14.18 |

| Orbit | 39,230 | 301.22 | 3.78 | 12.24 | 16.45 | 0 | 0 | -15.91 | 16.56 | 11.64 |

| Gateway | 2,890 | 24.53 | 4.42 | 11.64 | 0 | 0 | 0.44 | 0 | 16.5 | 31.77 |

| Amicus Horizon | 25,910 | 170.52 | 8.13 | 6.41 | 0 | 0.41 | 0.95 | 0.33 | 16.24 | 12.28 |

| Fortis Living | 15,000 | 94.84 | 3.11 | 9.42 | 0 | 0.79 | 2.02 | 0.49 | 15.83 | 20.39 |

| MHS | 8,600 | 51.6 | 0.99 | 9.95 | 0 | 3.2 | 0 | 1.54 | 15.68 | 10.61 |

| Johnnie Johnson | 5,040 | 26.39 | 5.41 | 3.02 | 0 | 0 | 7.24 | 0 | 15.67 | 15.12 |

| Flagship | 22,320 | 127.06 | 2.82 | 8.1 | 0 | 3.38 | 0 | 1.32 | 15.62 | 13.37 |

| Aster | 28,650 | 178.98 | 2.44 | 8.73 | 1.8 | 0.45 | 1.64 | 0.51 | 15.58 | 15.27 |

| Poplar Harca (a) | 9,140 | 54.67 | 0 | 2.23 | 0 | 0 | 6.36 | 6.7 | 15.29 | 12.44 |

| Bromford | 29,110 | 165.25 | 5.18 | 9.19 | 0 | 0.34 | 0.32 | 0.07 | 15.11 | 12.58 |

| Howard Cottage (a) | 1,650 | 11.4 | 0 | 14.92 | 0 | 0 | 0 | 0 | 14.92 | 9.43 |

| Shepherds Bush | 5,050 | 43.39 | 10.79 | 1.36 | 0 | 0 | 2.5 | 0 | 14.65 | 13.27 |

| Trafford | 8,890 | 54.37 | 0.48 | 3.42 | 0 | 0.7 | 0 | 10.03 | 14.63 | 7.95 |

| Grand Union (a) | 10,660 | 63.91 | 0 | 10.04 | 0 | 0.96 | 2.3 | 0.83 | 14.13 | 7.3 |

| Coast & Country (a) | 10,580 | 61.12 | 0 | 4.95 | 5.5 | 0.89 | 0 | 2.7 | 14.03 | 15.04 |

| Bournville Village* | 4,080 | 26.8 | 1.01 | 2.51 | 0 | 1.65 | 4.56 | 4.11 | 13.84 | 15.59 |

| South Yorkshire (a) | 5,720 | 47.29 | 0 | 6.57 | 0 | 0 | 0 | 7.18 | 13.75 | 9.34 |

| Curo | 12,990 | 74.64 | 1.56 | 6 | 0 | 3.2 | 1.9 | 0.79 | 13.45 | 10.49 |

| Chelmer Housing | 9,140 | 51.34 | 1.8 | 5.59 | 3.17 | 2.16 | 0 | 0.43 | 13.16 | 9.46 |

| West Kent | 6,900 | 46.05 | 3.88 | 7.56 | 0 | 0 | 1.22 | 0.08 | 12.74 | 13.48 |

| Leeds Federated | 4,270 | 23.02 | 2.47 | 6.38 | 0 | 3.36 | 0 | 0.37 | 12.57 | 10.63 |

| Bracknell Forest | 7,120 | 41.65 | 0.83 | 9.42 | 0 | 0 | 2.26 | 0 | 12.51 | 7.4 |

| Cambridge Housing | 2,810 | 28.57 | 3.8 | 4.62 | 0 | 0 | 4.06 | 0 | 12.48 | 11.03 |

| Bernicia | 9,690 | 46.09 | 0.81 | 0.4 | 0 | 8.6 | 0.7 | 1.53 | 12.03 | 11.51 |

| Adactus | 13,210 | 71.18 | 3.1 | 8.66 | 0 | 0 | 0 | 0 | 11.76 | 5.08 |

| Derwentside Homes | 7,060 | 33.96 | 0 | 0 | 0 | 5.7 | 1.21 | 4.61 | 11.52 | 9.79 |

| Riverside | 52,950 | 365.6 | 1.44 | 1.09 | 6.9 | 0.91 | 0 | 0.53 | 10.86 | 10.87 |

| Alliance Homes (a) | 6,870 | 39.65 | 0 | 1.4 | 0 | 0 | 4.47 | 4.59 | 10.46 | 8 |

| Accent | 20,780 | 101.42 | 3.49 | 5.47 | 0 | 0 | 0 | 1.47 | 10.43 | 18.03 |

| Suffolk** (a) | 2,880 | 19.52 | 0 | 5.64 | 0 | 0.78 | 0 | 3.83 | 10.26 | 4.72 |

| Muir | 5,470 | 29.84 | 4.46 | 5.11 | 0 | 0 | 0 | 0.38 | 9.94 | 11.44 |

| WM | 30,790 | 151.86 | 3.55 | 2.14 | 0.09 | 0.22 | 0.91 | 2.62 | 9.54 | 7 |

| Stonewater | 30,000 | 171.75 | 3.71 | 5.44 | 0 | 0 | 0 | 0.21 | 9.37 | 8.34 |

| Progress | 10,040 | 72.39 | 0.64 | 0.29 | 0 | 0.64 | 0.18 | 7.57 | 9.33 | 9.58 |

| Axiom | 2,260 | 17.09 | 0.61 | 0.56 | 0 | 0 | 0 | 8.04 | 9.22 | 4.90 |

| Rooftop (a) | 6,830 | 39.06 | 0 | 7.84 | 0 | 0 | 0 | 1.25 | 9.08 | 6.12 |

| Your | 34,390 | 195.03 | 3.9 | 2.95 | 0 | 1.99 | 0 | 0 | 8.84 | 9.53 |

| Impact* (a) | 3,100 | 18.91 | 0 | 6.88 | 0 | 1.82 | 0 | 0 | 8.70 | 2.88 |

| Plymouth Community | 15,830 | 66.84 | 0.22 | 2.88 | 3.52 | 0 | 1.94 | 0 | 8.57 | 6.02 |

| New Charter | 19,960 | 103.19 | 0 | 0 | 0 | 0 | 0 | 8.18 | 8.18 | 9.62 |

| Regenda | 12,960 | 62.13 | 4.48 | 2.03 | 0 | 0.84 | 0 | 0.82 | 8.17 | 6.65 |

| Nottingham Community | 9,250 | 69.6 | 3.22 | 3.32 | 0 | 1.24 | 0 | 0.16 | 7.94 | 8.36 |

| Midland Heart | 33,020 | 207.92 | 3.03 | 3.27 | 0.35 | 0.57 | 0.44 | 0.09 | 7.76 | 7.88 |

| Golding Homes (a) | 7,260 | 40.1 | 0 | 6.45 | 0.19 | 0 | 1.05 | 0 | 7.7 | 3.03 |

| Home | 54,760 | 350.84 | 1.61 | 3.94 | 0.09 | 1.52 | 0 | 0.39 | 7.56 | 7.82 |

| Hanover (a) | 18,900 | 116.72 | 0 | 0.3 | 4.86 | 0 | 0 | 2.21 | 7.37 | 2.41 |

| Colne | 3,070 | 18.44 | 1.67 | 5.24 | 0 | 0 | 0 | 0 | 6.91 | 1.75 |

| East Midlands | 18,620 | 98.7 | 3.74 | 3.03 | 0 | 0 | 0 | 0 | 6.77 | 6.3 |

| Trident | 3,410 | 33.13 | 0.98 | 0 | 0 | 5.02 | 0 | 0.71 | 6.72 | 7.73 |

| Mosscare | 4,970 | 24.75 | 1.02 | 2.09 | 0.36 | 0.23 | 0 | 2.81 | 6.51 | 2.95 |

| Habinteg | 3,270 | 22.81 | 0 | 0 | 0 | 0 | 5.05 | 1.31 | 6.36 | 5.39 |

| Irwell Valley | 7,710 | 35.99 | 5.45 | 0 | 0 | 0 | 0 | 0.79 | 6.24 | 7.31 |

| Total 120 HAs | 2,178,860 | 15,555 | 3.8% | 7.2% | 9.4% | 1.9% | 2.3% | 3.3% | 28% | 25.2% |

Notes: * = accounts year ended Dec 2015; (a) = rental income from shared ownership not itemised in the accounts: percentage figure in final column would be higher if this item were stated. Source: HA audited accounts year ended March 2016, except (*) year ended December 2015; ** year end changed so 2016 is 15 months; *** EU IFRS accounting standard

Shared ownership rent

Income from rent and service charges on shared ownership properties rose by more than 12 per cent. Rental income from shared ownership homes should continue rising in 2016/17 because it is not subject to the four-year one per cent rent cut that applied to social housing from April 2016.

Only eight associations saw a fall in their shared ownership rental income in 2016.

There were 10 organisations that did not list rental income from shared ownership, but did have first tranche income. It is likely that they did have shared ownership rent, but had included it in their social housing rent figure. Consequently the shared ownership rent and share of turnover from non-social income figures for those organisations would be higher had they specified their shared ownership rental income. Three associations were not involved in shared ownership, as they had neither shared ownership rent nor first tranche income.

Property sales income 15/16: top 20 HAs

| 2015/16 £m | 2014/15 £m | Change on year | |

|---|---|---|---|

| L&Q | 211 | 204 | +3% |

| A2 Dominion | 113.6 | 75.8 | +50% |

| Network | 105.8 | 28.4 | +273% |

| Peabody | 100.6 | 10.4 | +871% |

| Places for People | 98.8 | 42.8 | +131% |

| One | 85.6 | 78.7 | +9% |

| Guinness | 82.9 | 45.1 | +84% |

| Notting Hill | 72.6 | 76.8 | -5% |

| Catalyst | 69.8 | 50.6 | +38% |

| Hyde | 59.8 | 51.9 | +15% |

| Genesis | 58.3 | 13.9 | +319% |

| Anchor Trust | 55.7 | 0 | n/a |

| Orbit | 49.6 | 27.8 | +79% |

| Swan | 42.2 | 15.9 | +165% |

| Family Mosaic | 42.1 | 29.2 | +45% |

| Gentoo Housing | 36 | 35.8 | +1% |

| Affinity Sutton | 26.5 | 65.6 | -60% |

| Riverside | 25.2 | 23.5 | +7% |

| Circle Anglia | 23.3 | 27.9 | -16% |

| Origin | 19.7 | 4.5 | +334% |

Individual HAs

Dependence on non-social housing activities for revenue varied hugely among the 120 associations surveyed. Brunelcare, unsurprisingly, made about three-quarters of its income from care and community services.

Many of the associations in the top 10 are active in shared ownership or building homes for outright sale.

At the bottom of the table are associations that make almost all of their income from social housing, apart from single-digit percentages from non-social sources, often shared ownership and non-social rent.

L&Q topped the table for income from property sales once again. About half of its sales came through joint ventures with house builders.

Unsurprisingly, given the inflated property prices in the region, the vast majority of the 20 associations that made the most from property sales work in London and the South East. The only association from outside this region in the top 20 was Gentoo, which works mainly in the North East. Its Gentoo Homes subsidiary launched 11 new developments and sold 162 homes in 2015/16.

The sector looks likely to become even more dependent on non-social housing income.

Notting Hill also remained at the top of the table for income from first tranche sales for another year. Again, the majority of providers in the top 20 for first tranche income work in London and the South East.

One association in the list, Housing & Care 21, specialises in housing for older people. It saw a rise in income from first tranche sales, selling 192 homes in 2016 – up from 101 the year before. Its completions peaked in 2014/15 and the number of properties available for sale over the next two years is significantly lower, which means the group has reduced risk from property sales, its accounts said.

First tranche sales income 15/16: top 20 HAs

| 2015/16 £m | 2014/15 £m | Change on year | |

|---|---|---|---|

| Notting Hill | 75.8 | 68.5 | +11% |

| Network | 59.7 | 24.6 | +143% |

| L&Q | 58 | 33 | +76% |

| Peabody | 47.2 | 14.5 | +225% |

| Affinity Sutton | 37.5 | 40.1 | -6% |

| Orbit | 36.9 | 17 | +117% |

| Hyde | 32.7 | 34.5 | -5% |

| East Thames | 28.5 | 15.5 | +84% |

| Sanctuary* | 28.2 | 20.2 | +40% |

| A2 Dominion | 26.1 | 12.4 | +110% |

| Paradigm | 25.1 | 18.2 | +38% |

| Moat | 25.1 | 16.7 | +51% |

| Catalyst | 22.2 | 40.2 | -45% |

| Thames Valley | 21.4 | 10.2 | +111% |

| Sovereign | 21.4 | 17.6 | +22% |

| Guinness | 20.3 | 10.2 | +99% |

| One | 20 | 11.2 | +79% |

| Genesis | 19.1 | 22.2 | -14% |

| Circle Anglia | 19 | 14.6 | +30% |

| Housing & Care 21 | 18.5 | 8.4 | +121% |

* EU IFRS accounting standard

Future risks

The Homes and Communities Agency’s Sector Risk Profile 2017 said the sector forecast a significant increase in development for sale and shared ownership, and that for the first time future development would be funded mainly by sales income rather than grant or debt. It warned: “It is vital that boards understand the market risks associated with sales revenues, and have plans in place should these revenues fail to be delivered.” It said boards should ensure social housing is not put at risk by guarantees, recourse or impairment relating to non-social assets.

By 2019, providers with more than 1,000 properties forecast that more than half of new homes developed will be for market rent, low-cost ownership or market sale. By that time, there will be four times more homes built for outright and shared ownership sale than in 2012. The rent cut will also take effect through to 2019/20, meaning the sector looks likely to become even more dependent on non-social housing income.

RELATED