Mayor reveals increase in grant rates with £2.2bn funding up for grabs

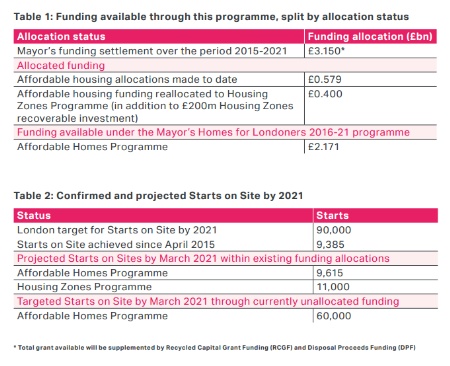

The Mayor of London has revealed increased grant rates for a new ‘genuinely affordable’ housing product, with £2.2bn available from the £3.15bn announced at the autumn statement.

Mayor Sadiq Khan and the Greater London Authority (GLA) have set out specific grant rates that will apply to all affordable homes delivered by partners under the Mayor’s Homes for Londoners: Affordable Homes Programme 2016-21.

It comes after Chancellor Philip Hammond set out plans for £3.15bn of affordable housing funding for London, which included some already allocated money, to deliver 90,000 homes.

The guidance states that the Mayor does not consider 80 per cent of market rents to be genuinely affordable in most parts of London and therefore expects most homes let for a new London Affordable Rent to be substantially below this level. This will be supported by grant rates of £60,000 per home.

However, that grant rate is inclusive of Recycled Capital Grant Funding (RCGF) and Disposals Proceed Funding (DPF) - which are topped up through asset disposals - so the new funding paid by the GLA will be lower where they are included.

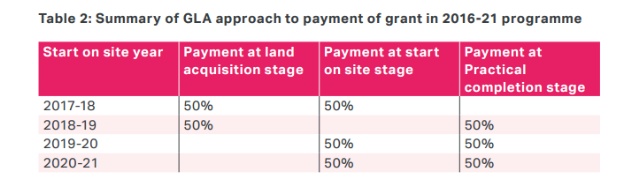

In 2017/18, half of the grant will be paid at land acquisition and the rest when the building starts (see table at bottom of story).

In considering bids for London Affordable Rent, the GLA will bear in mind the need to deliver 58,500 London Living Rent and London Shared Ownership homes (see below).

The Mayor’s guidance confirms there is £2.17bn of funds available under the 2016-21 programme. The Mayor may also consider moving funds into its Housing Zones programme to increase levels of affordable housing in existing, or additional, zones.

The detail comes after Gavin Barwell – both housing minister and minister for London – said he expects bids to be closer to affordable rent levels than social rent, as government looks to ‘maximise’ the supply it sees for its money.

The GLA grant rate guidance includes:

• London Affordable Rent - £60,000 per home - inclusive of RCGF/DPF - when rent is set at or below the benchmark levels;

• London Living Rent and London Shared Ownership – £28,000 (inclusive of RCGF) per home.

Only these products can be funded through the set grant rates, but other ‘genuinely affordable’ products may be brought into the programme on a nil-grant basis, through a developer-led approach below, or at negotiated grant levels.

The GLA said it will fund a small number of projects at negotiated grant rates and take the approach when funding supported housing projects, which vary in cost far more than standard affordable housing projects.

The ‘approved provider’ route is open to all providers of affordable housing who ensure that at least half of their London housing starts between April 2015 and March 2021 are affordable homes; deliver their programme on sites controlled by them or by joint-ventures in which they have at least a 50 per cent share; and intend to, either as themselves or as part of a consortium, own the completed affordable homes.

The GLA will also launch ‘strategic investment partnerships’, working with a small number of major providers who will be delivering at scale through the programme period and could be supported to do more by working at a more strategic level. They must be willing to commit to bringing forward at least 600 affordable homes within a wider delivery programme consisting of at least 60 per cent affordable housing. They would benefit from higher levels of investment than that which is available through the set grant rate programme, but they would be expected to return some of that investment back to the GLA in the form of overage, should their programmes outperform assumptions.

Smaller associations are also encouraged to bid. The Mayor recognises the significant capacity and says set grant rates should provide ‘certainty and clarity’, but also ‘warmly welcomes the formation of new consortium arrangements to benefit from economies of scale and development experience’ and using development arrangements offered by larger providers.

It adds that ensuring affordable housing providers have access to sufficient land ‘in the right places and at the right prices will be fundamental to the success of this programme’, and the GLA is ‘keen to support partners by whatever means necessary to achieve this’.

The Mayor is developing a Good Practice Guide to Estate Regeneration and providers who bid for grant to deliver estate regeneration will need to contractually commit to these standards for their estate regeneration projects.

Developers will also face scrutiny over ensuring that 35 per cent of schemes are affordable, amid plans for a ‘clearer and more consistent’ approach to assessing the viability of delivering affordable homes through the planning system. Once the minimum viable level of affordable housing is established by the Local Planning Authority, GLA grant at £28,000 per affordable home will be available through the developer-led route to increase the level of affordable housing. Bids for this grant are invited from providers that will own the completed affordable homes.

There will be an initial bidding round and then ongoing bids.

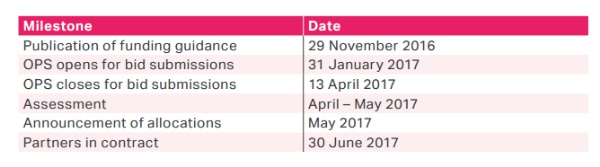

During bids, the GLA will consider the deliverability, London borough feedback and regulator feedback. Providers will need to submit funding bids through the GLA’s new Open Project System (OPS), which is replacing the HCA’s Investment Management System (IMS) for new projects funded by the Mayor. The landlord of all properties funded as London Affordable Rent and London Living Rent must be registered with the social housing regulator.

London Affordable Rent

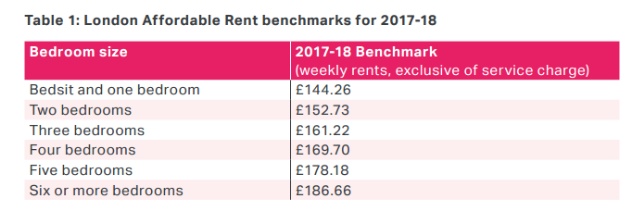

The GLA says the starting point for London Affordable Rent should be the benchmarks for homes which are let in 2017/18 (see table below).

These benchmarks reflect the formula rent cap figures for social rents uprated by CPI for September 2016 plus one per cent.

The benchmarks will change each April by the increase in CPI (for the previous September) plus one per cent and updated benchmarks will be published by the GLA on an annual basis. Other rent levels for London Affordable Rent will also be considered, where the provider is able to demonstrate to the GLA’s satisfaction that the homes would be genuinely affordable.

London Affordable Rent homes will be subject to rent-setting guidance issued by the social housing regulator and will be subject to the annual one per cent rent reductions up to 2020.

Providers have the flexibility to charge less than the benchmark, and they exclude service charges, which may be charged in addition.

For legal and regulatory purposes, the GLA views London Affordable Rent as ‘affordable rent’ and so they will have to be set in accordance with the social housing regulator’s affordable rent guidance. The landlord of these homes must be registered with the social housing regulator.

London Living Rent

The Mayor is introducing London Living Rent as an intermediate affordable housing product with locally specified rents.

When funded through this programme, London Living Rent is a rent to buy product with sub-market rents on time-limited tenancies. It is aimed at helping households on average income levels to save for a deposit to buy their own home.

Eligibility for London Living Rent is restricted to existing private and social renters with a maximum household income of £60,000, without sufficient current savings to purchase a home in the local area.

London Shared Ownership

London Shared Ownership homes aim to allow a home buyer to purchase a share in a new home, and pay a regulated rent on the remaining, unsold share.

Purchasers will need household incomes that can support an initial purchase of between 25 per cent and 75 per cent of the value of a property, and usually a mortgage deposit of around 10 per cent. It will be available to Londoners who have a maximum household income of £90,000.

Initial rents on the unsold equity of London Shared Ownership properties can be no more than 2.75 per cent of the value of the unsold equity at the point of initial sale.

The guidance says a common complaint from shared owners is a lack of transparency over service charges, ‘causing confusion and dissatisfaction for those affected’.

The Mayor is encouraging providers to commit to working together to standardise approaches to service charges and, where possible, reducing these charges for consumers.

Providers of shared ownership are invited to work together to propose a charter on shared ownership service charges to the Mayor. It is hoped that this will address concerns and commit providers to meaningful positive action, which may be endorsed by the Mayor and become an important standard for consumer protection.

The GLA says this ‘charter’ will be the key distinguishing feature for London Shared Ownership.

Supported/specialist housing

Providers are also encouraged to bring forward supported and specialised housing projects for vulnerable Londoners.

It says the Mayor has existing funding streams available for providers to utilise, and is keen to support the provision of supported and specialised housing in:

• Specialised housing for disabled or older Londoners

• Accommodation for those who are homeless, or at risk of being homeless

• Move-on accommodation

• Other forms of supported and specialised housing.

Payment of grant

RELATED