HRA business planning: learning from housing associations

Steve Partridge of Savills takes a look at the financial factors councils should consider in their Housing Revenue Account business planning

The abolition of the cap on Housing Revenue Account (HRA) borrowing in the 2018 Autumn Budget has raised a whole range of questions.

What is a realistic and achievable target for local authorities to contribute to the development of new affordable housing? What does a sensible and proportionate borrowing strategy look like for the HRA? How do authorities go about setting their own borrowing capacity limits now that the government is not doing it for them?

In the December 2018 edition of Social Housing, Savills published some preliminary work that identified possible borrowing capacity for local authorities as a whole, based on an initial view of authorities’ interest cover at a national level and on 2017 figures. In this feature, we look at key metrics for individual authorities and take a more granular view of the financial factors affecting HRA business plans, updated to 2018 figures. This is the first of a series of analyses that we hope will underpin the debate on future capacity.

Savills undertook some research for the Association of Retained Council Housing and the National Federation of ALMOs in 2017 that considered how local authorities with HRAs might usefully learn from the successful experience of 30 years of private finance for housing associations (HAs). With the cap lifted, now is the time to take the analysis a stage further and test the ‘art of the possible’ for the HRA.

Introducing the HRA

This year is the 100th anniversary of the Addison Act, which introduced a national council housing programme. Over time, the HRA emerged as the statutory way to account for council housing locally, until 2012 always with a national influence.

Many readers will be familiar with the HRA as a ringfenced income and expenditure account for council housing within a local authority’s overall services. The HRA contains everything you’d expect for a social housing rental service: income from rents and service charges, operational costs of management, maintenance and major repairs, and debt costs (interest and repayments).

However, there are some fundamental differences to HAs – all of which arise from the fact that the HRA is part of the local government accounting system, public-funded, statutory reporting frameworks that have been in place for decades. Here are seven of the more important differences:

- Separate accounting and financing for revenue and capital: the HRA must balance revenue income and expenditure (a statutory requirement since 1990) and cannot be deficit budgeted; capital expenditure must be separately accounted for and explicitly financed – some sources of finance can only be used for capital, such as capital receipts and borrowing.

- Depreciation is ‘cash backed’, the equivalent of an HA’s ‘major repairs charged to income and expenditure’: a charge to the HRA representing depreciation is credited to a major repairs reserve and funds from that reserve are released for major repairs expenditure on the stock.

- HRA debt is almost exclusively borrowed from the Public Works Loan Board (PWLB) at low rates linked to gilts; as for registered providers, most loans are maturity loans on fixed rates and interest rate risk is mitigated effectively through having a range of loans at various lengths, allowing refinancing to take advantage of rate movements.

- HRA debt is usually pooled with other council debt: interest charged to the HRA is based on an average across the entire borrowings of the authority, rather than on the basis of specific loans. Although this is changing, particularly since the 2012 self-financing debt settlement, the majority of HRA debt is pooled, and this means interest rate exposure is further mitigated across a larger pool of borrowing.

- HRA debt is measured through the Capital Financing Requirement (CFR): this is the underlying need to have borrowed to finance capital expenditure, not the actual loans in place; this is akin to an offset mortgage where, for example, the actual loan might be higher than the net indebtedness, or where the council has used cash from the rest of its services to ‘internally’ lend to the HRA – interest is charged on the CFR.

- There is not a separate ringfenced balance sheet for the HRA; the valuation basis for dwellings is Existing Use Value (as for HAs) but rather than being cash flow based, it is based on a discounted open market valuation – the discounts are on a regional basis and periodically published by the Ministry of Housing, Communities and Local Government.

- Debt is not raised against asset values – councils borrow based on the Chartered Institute of Public Finance and Accountancy (CIPFA) Prudential Code under which authorities set prudential indicators (PIs) relating to the prudence of their borrowing – PIs are akin to HA covenants but do not operate in the same way as the code is self-regulated with auditors rather than dependent on the view of external funders.

When looking across both sectors, it is essential that the points above are factored in. Fundamentally, however, as the HRA for a council is doing the same job as the income and expenditure account for an HA, an HRA has debt just as an HA does, we are able to make meaningful comparisons on many levels – and we hope that this helps to expand the thinking around HRA business planning.

Introducing the table

The table (titled ‘Local authorities with HRAs’, see below) shows authority-level data extracted from CIPFA’s HRA statistics relating to the year ended 31 March 2018 – they cover the same period as the 2018 HA global accounts published in December.

In presenting the data, we have made some assumptions about grouping headings together to enable comparability. We have excluded two authorities that have private finance initiative stock only. Readers will note local and individual factors at play for some authorities – we will do more work to understand the impact of these.

The table sets out the following main factors.

- Total stock: as at 31 March 2018, virtually all traditional social housing but with some shared ownership and some affordable rent provision and conversions under the Shared Ownership and Affordable Homes Programme.

- Turnover 2017/18: gross rents less voids loss plus all tenanted and leaseholder service charges for dwellings plus rents on non-dwellings (including garages and shops on estates); turnover also includes contributions made by other council services (for example for grounds maintenance) and some revenue grants.

- Operating expenditure 2017/18: covers housing management, service costs, day-to-day repairs and maintenance, cyclical and planned repairs, plus the amount of money moved to the major repairs reserve; also includes contributions to bad debt provision, lease costs and the cost of council tax on empty properties.

- Operating surplus and operating margin 2017/18: turnover less operating costs compared to turnover.

- Gross asset value: as at 31 March 2018, this includes dwellings at Existing Use Value and fair value of other assets, typically garages, shops and offices; asset value per housing unit is shown from the gross value because the relative value of other assets is low.

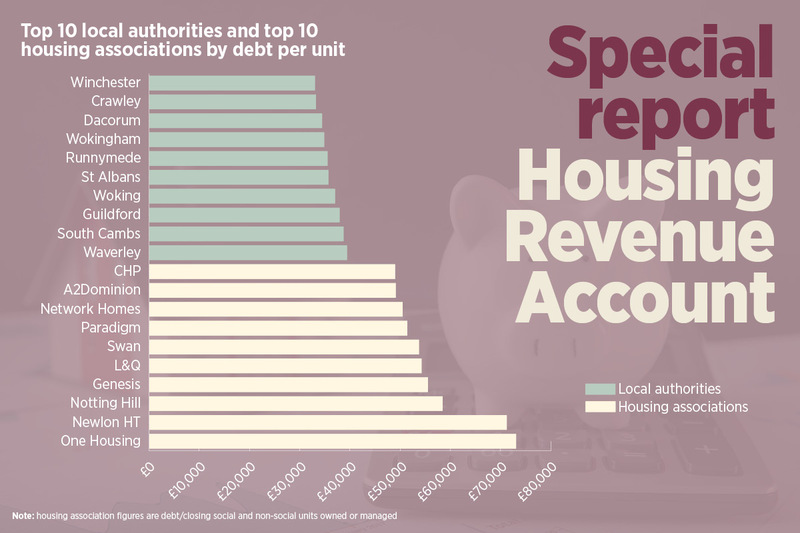

- Debt and debt per unit: the level of indebtedness as measured by the CFR as 31 March 2018, per unit at the same date.

- Interest and interest cover: interest costs for 2017/18 compared to operating surplus over the same period.

Interest cover is a key metric/covenant for the HA sector and funders. It is a primary way of measuring the potential capacity for further borrowing but also the resilience of HAs to changes in government policy, inflation and interest rates. Comparisons can usefully be made between the two sectors.

Other key covenants for HAs include gearing, asset cover, loan to value etc. Here, comparisons with the HRA are more difficult as the ability of an authority to borrow is not explicitly constrained by asset value cover. We will aim to do some more work with individual councils on the figures in a subsequent feature, and to report on asset cover and gearing in an HRA context.

Local authorities with HRAs (as at March 2018)

| Total | 1,586,682 | 95,808,876 | 60,383 | 26,012,815 | 16,394 | 646 | 8,267,523 | 5,980,325 | 2,287,198 | 27.66 | 2.23 | |

| Local authority | Region | No of units | Total assets (£000) | Asset value per unit (£) | Debt (£000) | Debt per unit (£) | Interest per unit (£) | Turnover (£000) | Operating cost (£000) | Operating surplus (£000) | Operating margin (%) | Cover ratio interest |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Birmingham | WM | 61,452 | 2,346,500 | 38,184 | 1,090,153 | 17,740 | 841 | 283,505 | 193,525 | 89,980 | 31.74 | 1.74 |

| Leeds | YH | 55,897 | 2,170,943 | 38,838 | 815,075 | 14,582 | 707 | 245,714 | 159,378 | 86,336 | 35.14 | 2.18 |

| Sheffield | YH | 39,559 | 1,309,331 | 33,098 | 345,969 | 8,746 | 361 | 155,322 | 111,004 | 44,318 | 28.53 | 3.10 |

| Southwark | Lon | 37,597 | 3,478,582 | 92,523 | 429,166 | 11,415 | 652 | 265,248 | 207,791 | 57,457 | 21.66 | 2.72 |

| Sandwell | WM | 28,771 | 1,042,727 | 36,242 | 437,645 | 15,211 | 954 | 133,173 | 76,503 | 56,670 | 42.55 | 2.06 |

| Bristol | SW | 27,038 | 1,695,313 | 62,701 | 244,568 | 9,045 | 411 | 121,807 | 89,152 | 32,655 | 26.81 | 2.94 |

| Nottingham | EM | 25,808 | 970,761 | 37,615 | 294,703 | 11,419 | 471 | 106,714 | 90,101 | 16,613 | 15.57 | 1.37 |

| Newcastle upon Tyne | NE | 25,698 | 873,738 | 34,000 | 360,738 | 14,038 | 634 | 111,923 | 90,964 | 20,959 | 18.73 | 1.29 |

| Islington | Lon | 25,294 | 3,241,029 | 128,134 | 442,261 | 17,485 | 998 | 216,517 | 164,612 | 51,905 | 23.97 | 2.06 |

| Kingston upon Hull | YH | 24,193 | 471,865 | 19,504 | 265,103 | 10,958 | 498 | 95,607 | 49,018 | 46,589 | 48.73 | 3.87 |

| Lambeth | Lon | 24,050 | 2,466,102 | 102,541 | 399,630 | 16,617 | 1,074 | 203,130 | 142,094 | 61,036 | 30.05 | 2.36 |

| Camden | Lon | 23,449 | 2,789,475 | 118,959 | 467,647 | 19,943 | 486 | 186,787 | 174,968 | 11,819 | 6.33 | 1.64 |

| Kirklees | YH | 22,569 | 614,386 | 27,223 | 237,740 | 10,534 | 383 | 92,887 | 75,888 | 16,999 | 18.30 | 1.96 |

| Wolverhampton | WM | 22,200 | 749,500 | 33,761 | 253,956 | 11,439 | 459 | 97,094 | 63,259 | 33,835 | 34.85 | 3.32 |

| Hackney | Lon | 21,966 | 2,535,606 | 115,433 | 100,080 | 4,556 | 6 | 141,093 | 129,833 | 11,260 | 7.98 | 93.06 |

| Dudley | WM | 21,943 | 877,973 | 40,012 | 470,300 | 21,433 | 800 | 89,313 | 62,426 | 26,887 | 30.10 | 1.53 |

| Wigan | NW | 21,915 | 585,382 | 26,711 | 298,766 | 13,633 | 650 | 95,127 | 65,580 | 29,547 | 31.06 | 2.07 |

| Greenwich | Lon | 20,959 | 1,517,669 | 72,411 | 334,630 | 15,966 | 702 | 119,606 | 94,840 | 24,766 | 20.71 | 1.68 |

| Leicester | EM | 20,791 | 935,021 | 44,972 | 214,052 | 10,295 | 493 | 83,195 | 59,724 | 23,471 | 28.21 | 2.29 |

| Rotherham | YH | 20,393 | 653,346 | 32,038 | 304,125 | 14,913 | 658 | 84,419 | 57,534 | 26,885 | 31.85 | 2.00 |

| Doncaster | YH | 20,170 | 667,196 | 33,079 | 266,025 | 13,189 | 586 | 75,729 | 51,915 | 23,814 | 31.45 | 2.01 |

| Gateshead | NE | 19,242 | 712,549 | 37,031 | 345,505 | 17,956 | 766 | 80,446 | 56,759 | 23,687 | 29.44 | 1.61 |

| Barnsley | YH | 18,498 | 569,731 | 30,800 | 271,734 | 14,690 | 560 | 73,075 | 52,389 | 20,686 | 28.31 | 2.00 |

| Stoke-on-Trent | WM | 18,179 | 527,042 | 28,992 | 156,641 | 8,617 | 356 | 67,849 | 59,623 | 8,226 | 12.12 | 1.27 |

| Barking & Dagenham | Lon | 17,773 | 1,020,803 | 57,436 | 279,072 | 15,702 | 545 | 109,738 | 73,690 | 36,048 | 32.85 | 3.72 |

| South Tyneside | NE | 17,051 | 584,168 | 34,260 | 287,503 | 16,861 | 684 | 67,575 | 54,555 | 13,020 | 19.27 | 1.12 |

| Wandsworth | Lon | 16,855 | 1,430,936 | 84,897 | 297,429 | 17,646 | 301 | 142,063 | 87,467 | 54,596 | 38.43 | 10.78 |

| Newham | Lon | 16,226 | 1,484,374 | 91,481 | 197,953 | 12,200 | 1,004 | 109,941 | 85,866 | 24,075 | 21.90 | 1.48 |

| Southampton | SE | 16,123 | 670,763 | 41,603 | 157,923 | 9,795 | 333 | 75,190 | 58,062 | 17,128 | 22.78 | 3.19 |

| Manchester | NW | 15,937 | 570,562 | 35,801 | 269,245 | 16,894 | 725 | 87,396 | 70,234 | 17,162 | 19.64 | 1.49 |

| Haringey | Lon | 15,350 | 1,325,015 | 86,320 | 226,273 | 14,741 | 687 | 117,140 | 79,261 | 37,879 | 32.34 | 3.59 |

| Norwich | East | 14,805 | 797,904 | 53,894 | 205,717 | 13,895 | 538 | 71,105 | 50,039 | 21,066 | 29.63 | 2.64 |

| North Tyneside | NE | 14,767 | 662,827 | 44,886 | 339,341 | 22,980 | 996 | 71,172 | 37,450 | 33,722 | 47.38 | 2.29 |

| Portsmouth | SE | 14,765 | 705,594 | 47,788 | 167,735 | 11,360 | 422 | 83,898 | 52,291 | 31,607 | 37.67 | 5.07 |

| Lewisham | Lon | 14,227 | 1,311,300 | 92,170 | 57,543 | 4,045 | 155 | 101,011 | 104,794 | -3,783 | -3.75 | -1.72 |

| Croydon | Lon | 13,571 | 990,000 | 72,950 | 322,497 | 23,764 | 905 | 92,307 | 62,904 | 29,403 | 31.85 | 2.39 |

| Hounslow | Lon | 13,129 | 995,000 | 75,786 | 230,956 | 17,591 | 712 | 85,773 | 64,007 | 21,766 | 25.38 | 2.33 |

| Derby | EM | 12,960 | 519,271 | 40,067 | 231,373 | 17,853 | 849 | 59,832 | 46,037 | 13,796 | 23.06 | 1.25 |

| Hammersmith & Fulham | Lon | 12,184 | 1,343,438 | 110,262 | 210,263 | 17,257 | 734 | 87,707 | 72,605 | 15,102 | 17.22 | 1.69 |

| Milton Keynes | SE | 12,116 | 646,056 | 53,323 | 230,832 | 19,052 | 685 | 55,938 | 33,883 | 22,055 | 39.43 | 2.66 |

| Ealing | Lon | 11,947 | 895,627 | 74,967 | 163,584 | 13,693 | 570 | 66,458 | 52,564 | 13,894 | 20.91 | 2.04 |

| Westminster | Lon | 11,869 | 1,359,122 | 114,510 | 261,283 | 22,014 | 1,019 | 113,494 | 111,204 | 2,290 | 2.02 | 0.19 |

| Tower Hamlets | Lon | 11,568 | 1,274,150 | 110,144 | 83,913 | 7,254 | 263 | 91,564 | 77,827 | 13,737 | 15.00 | 4.52 |

| Brighton & Hove | SE | 11,552 | 1,996,910 | 172,863 | 125,502 | 10,864 | 468 | 58,633 | 38,641 | 19,992 | 34.10 | 3.70 |

| Northampton | EM | 11,551 | 574,790 | 49,761 | 186,853 | 16,176 | 546 | 53,466 | 51,423 | 2,043 | 3.82 | 0.32 |

| East Riding of Yorkshire | YH | 11,349 | 435,421 | 38,366 | 233,039 | 20,534 | 681 | 49,581 | 27,264 | 22,317 | 45.01 | 2.89 |

| Stockport | NW | 11,190 | 432,470 | 38,648 | 132,967 | 11,883 | 496 | 48,962 | 40,838 | 8,124 | 16.59 | 1.46 |

| Basildon | East | 10,813 | 817,211 | 75,577 | 205,306 | 18,987 | 919 | 53,508 | 39,192 | 14,316 | 26.75 | 1.44 |

| Cornwall | SW | 10,317 | 502,654 | 48,721 | 109,597 | 10,623 | 325 | 40,187 | 32,586 | 7,601 | 18.91 | 2.26 |

| Swindon | SW | 10,299 | 440,779 | 42,798 | 114,016 | 11,071 | 272 | 50,173 | 35,190 | 14,983 | 29.86 | 5.34 |

| Enfield | Lon | 10,221 | 727,300 | 71,157 | 178,805 | 17,494 | 782 | 70,214 | 46,943 | 23,271 | 33.14 | 2.91 |

| Dacorum | East | 10,104 | 904,687 | 89,538 | 346,740 | 34,317 | 1,148 | 56,937 | 36,060 | 20,877 | 36.67 | 1.80 |

| Waltham Forest | Lon | 10,020 | 862,749 | 86,103 | 200,631 | 20,023 | 932 | 62,792 | 44,596 | 18,196 | 28.98 | 1.95 |

| Solihull | WM | 9,956 | 425,899 | 42,778 | 172,895 | 17,366 | 735 | 44,559 | 32,089 | 12,470 | 27.99 | 1.70 |

| Hillingdon | Lon | 9,925 | 760,473 | 76,622 | 190,643 | 19,208 | 643 | 61,009 | 36,294 | 24,715 | 40.51 | 3.87 |

| Thurrock | East | 9,919 | 745,442 | 75,153 | 181,843 | 18,333 | 552 | 54,347 | 45,183 | 9,164 | 16.86 | 1.67 |

| Barnet | Lon | 9,819 | 1,968,000 | 200,428 | 201,614 | 20,533 | 756 | 59,795 | 49,854 | 9,942 | 16.63 | 1.34 |

| Havering | Lon | 9,560 | 592,547 | 61,982 | 174,669 | 18,271 | 612 | 57,248 | 38,088 | 19,160 | 33.47 | 3.27 |

| Harlow | East | 9,279 | 748,685 | 80,686 | 187,370 | 20,193 | 731 | 49,235 | 39,754 | 9,481 | 19.26 | 1.40 |

| Chesterfield | EM | 9,150 | 350,860 | 38,345 | 132,344 | 14,464 | 542 | 38,113 | 27,522 | 10,591 | 27.79 | 2.13 |

| Welwyn Hatfield | East | 8,916 | 986,187 | 110,609 | 240,571 | 26,982 | 748 | 52,022 | 34,196 | 17,826 | 34.27 | 2.67 |

| Northumberland | YH | 8,540 | 318,351 | 37,278 | 105,145 | 12,312 | 474 | 32,380 | 24,496 | 7,884 | 24.35 | 1.95 |

| Brent | Lon | 8,005 | 649,300 | 81,112 | 148,574 | 18,560 | 791 | 55,742 | 41,718 | 14,024 | 25.16 | 2.21 |

| Stevenage | East | 7,983 | 633,712 | 79,383 | 206,006 | 25,806 | 879 | 43,286 | 29,446 | 13,840 | 31.97 | 1.97 |

| Bury | NW | 7,934 | 233,197 | 29,392 | 118,784 | 14,972 | 559 | 30,751 | 22,820 | 7,931 | 25.79 | 1.79 |

| Ipswich | East | 7,902 | 432,915 | 54,785 | 118,855 | 15,041 | 472 | 36,223 | 20,449 | 15,774 | 43.55 | 4.23 |

| Crawley | SE | 7,871 | 615,227 | 78,164 | 260,325 | 33,074 | 1,056 | 47,025 | 24,183 | 22,842 | 48.57 | 2.75 |

| North East Derbyshire | EM | 7,862 | 366,569 | 46,625 | 173,478 | 22,065 | 675 | 32,309 | 20,650 | 11,659 | 36.09 | 2.20 |

| Luton | East | 7,731 | 482,058 | 62,354 | 123,991 | 16,038 | 611 | 37,423 | 30,628 | 6,795 | 18.16 | 1.44 |

| Oxford | SE | 7,715 | 737,795 | 95,631 | 198,528 | 25,733 | 998 | 45,451 | 28,366 | 17,085 | 37.59 | 2.22 |

| York | YH | 7,656 | 467,971 | 61,125 | 139,034 | 18,160 | 583 | 33,352 | 22,160 | 11,192 | 33.56 | 2.51 |

| Lincoln | EM | 7,643 | 245,182 | 32,079 | 58,503 | 7,654 | 302 | 28,689 | 25,708 | 2,981 | 10.39 | 1.29 |

| Cambridge | East | 7,170 | 656,142 | 91,512 | 214,321 | 29,891 | 1,045 | 42,479 | 24,742 | 17,737 | 41.75 | 2.37 |

| Kensington & Chelsea | Lon | 6,830 | 840,195 | 123,015 | 210,164 | 30,771 | 1,349 | 61,353 | 53,190 | 8,163 | 13.30 | 0.89 |

| Reading | SE | 6,778 | 474,695 | 70,035 | 189,341 | 27,935 | 986 | 41,292 | 21,947 | 19,345 | 46.85 | 2.89 |

| Bassetlaw | EM | 6,750 | 293,012 | 43,409 | 92,357 | 13,683 | 561 | 26,887 | 19,567 | 7,320 | 27.23 | 1.93 |

| Ashfield | EM | 6,747 | 223,626 | 33,145 | 80,081 | 11,869 | 526 | 24,364 | 15,184 | 9,180 | 37.68 | 2.59 |

| Mansfield | EM | 6,508 | 215,943 | 33,181 | 81,437 | 12,513 | 453 | 28,055 | 19,602 | 8,453 | 30.13 | 2.86 |

| Epping Forest | East | 6,374 | 695,605 | 109,132 | 146,749 | 23,023 | 864 | 35,192 | 25,159 | 10,033 | 28.51 | 1.82 |

| Slough | SE | 6,154 | 535,484 | 87,014 | 158,077 | 25,687 | 841 | 36,568 | 29,850 | 6,718 | 18.37 | 1.30 |

| South Kesteven | EM | 6,078 | 237,638 | 39,098 | 106,070 | 17,451 | 484 | 26,394 | 16,793 | 9,601 | 36.38 | 3.26 |

| Southend-on-Sea | East | 5,980 | 369,116 | 61,725 | 98,740 | 16,512 | 546 | 28,922 | 19,156 | 9,766 | 33.77 | 2.99 |

| Colchester | East | 5,950 | 355,165 | 59,692 | 127,933 | 21,501 | 951 | 30,001 | 21,459 | 8,542 | 28.47 | 1.51 |

| West Lancashire | NW | 5,932 | 171,359 | 28,887 | 80,106 | 13,504 | 515 | 25,689 | 15,905 | 9,784 | 38.09 | 3.20 |

| Sutton | Lon | 5,875 | 421,836 | 71,802 | 171,603 | 29,209 | 1,037 | 38,151 | 25,021 | 13,130 | 34.42 | 2.15 |

| Great Yarmouth | East | 5,829 | 231,117 | 39,650 | 81,418 | 13,968 | 440 | 23,664 | 17,117 | 6,547 | 27.67 | 2.55 |

| Redditch | WM | 5,782 | 267,808 | 46,318 | 122,158 | 21,127 | 722 | 24,449 | 19,353 | 5,096 | 20.84 | 1.22 |

| Nuneaton & Bedworth | WM | 5,744 | 200,771 | 34,953 | 77,518 | 13,495 | 371 | 25,876 | 19,584 | 6,292 | 24.32 | 2.95 |

| Taunton Deane | SW | 5,737 | 288,904 | 50,358 | 104,850 | 18,276 | 473 | 26,803 | 22,688 | 4,115 | 15.35 | 1.52 |

| Gravesham | SE | 5,686 | 318,698 | 56,050 | 88,665 | 15,594 | 452 | 29,003 | 19,705 | 9,298 | 32.06 | 3.62 |

| Charnwood | EM | 5,610 | 263,808 | 47,025 | 81,552 | 14,537 | 481 | 22,477 | 14,252 | 8,225 | 36.59 | 3.05 |

| Warwick | WM | 5,490 | 351,168 | 63,965 | 135,787 | 24,734 | 858 | 27,097 | 16,855 | 10,242 | 37.80 | 2.17 |

| Newark & Sherwood | EM | 5,465 | 288,396 | 52,771 | 100,467 | 18,384 | 746 | 22,540 | 14,019 | 8,521 | 37.80 | 2.09 |

| Cheshire West and Chester | NW | 5,397 | 183,390 | 33,980 | 102,315 | 18,958 | 447 | 22,631 | 12,847 | 9,784 | 43.23 | 4.05 |

| Darlington | NE | 5,336 | 112,518 | 21,087 | 70,225 | 13,161 | 538 | 24,188 | 11,522 | 12,666 | 52.36 | 4.41 |

| Wiltshire | SW | 5,311 | 304,445 | 57,323 | 123,297 | 23,215 | 692 | 25,810 | 20,856 | 4,954 | 19.19 | 1.35 |

| South Cambridgeshire | East | 5,298 | 491,049 | 92,686 | 204,429 | 38,586 | 1,358 | 31,627 | 16,880 | 14,747 | 46.63 | 2.05 |

| Guildford | SE | 5,212 | 515,176 | 98,844 | 197,024 | 37,802 | 960 | 32,641 | 16,934 | 15,707 | 48.12 | 3.14 |

| Central Bedfordshire | East | 5,196 | 437,564 | 84,212 | 164,895 | 31,735 | 758 | 29,171 | 19,839 | 9,332 | 31.99 | 2.37 |

| Stroud | SW | 5,171 | 281,516 | 54,441 | 95,742 | 18,515 | 667 | 23,341 | 16,188 | 7,153 | 30.65 | 2.07 |

| Cannock Chase | WM | 5,158 | 185,017 | 35,870 | 81,039 | 15,711 | 629 | 20,281 | 11,035 | 9,246 | 45.59 | 2.85 |

| Canterbury | SE | 5,116 | 320,298 | 62,607 | 84,687 | 16,553 | 460 | 25,927 | 16,312 | 9,615 | 37.08 | 4.09 |

| Bournemouth | SW | 5,115 | 310,935 | 60,789 | 58,276 | 11,393 | 471 | 24,996 | 17,973 | 7,023 | 28.10 | 2.92 |

| Bolsover | EM | 5,084 | 178,071 | 35,026 | 104,134 | 20,483 | 675 | 23,307 | 15,501 | 7,806 | 33.49 | 2.27 |

| New Forest | SE | 5,021 | 368,181 | 73,328 | 144,601 | 28,799 | 889 | 27,960 | 18,334 | 9,626 | 34.43 | 2.16 |

| Winchester | SE | 4,987 | 456,511 | 91,540 | 164,022 | 32,890 | 1,039 | 29,193 | 17,896 | 11,297 | 38.70 | 2.18 |

| Ashford | SE | 4,965 | 282,613 | 56,921 | 118,473 | 23,862 | 506 | 29,969 | 15,603 | 14,366 | 47.94 | 5.71 |

| Exeter | SW | 4,884 | 267,953 | 54,863 | 57,882 | 11,851 | 407 | 21,100 | 13,659 | 7,441 | 35.27 | 3.74 |

| St Albans | East | 4,877 | 584,279 | 119,803 | 173,416 | 35,558 | 1,039 | 28,087 | 17,787 | 10,300 | 36.67 | 2.03 |

| Harrow | Lon | 4,813 | 460,051 | 95,585 | 150,984 | 31,370 | 1,313 | 32,485 | 26,237 | 6,248 | 19.23 | 0.99 |

| Waverley | SE | 4,803 | 397,288 | 82,717 | 188,700 | 39,288 | 1,207 | 29,993 | 16,473 | 13,520 | 45.08 | 2.33 |

| Blackpool | NW | 4,747 | 116,297 | 24,499 | 4,849 | 1,021 | 81 | 18,770 | 14,766 | 4,004 | 21.33 | 10.45 |

| Corby | EM | 4,673 | 217,440 | 46,531 | 78,587 | 16,817 | 523 | 19,266 | 14,650 | 4,616 | 23.96 | 1.89 |

| Kingston upon Thames | Lon | 4,612 | 389,155 | 84,379 | 131,411 | 28,493 | 951 | 32,257 | 26,086 | 6,171 | 19.13 | 1.41 |

| Poole | SW | 4,517 | 277,782 | 61,497 | 86,455 | 19,140 | 691 | 22,253 | 15,152 | 7,101 | 31.91 | 2.28 |

| Cheltenham | SW | 4,477 | 211,973 | 47,347 | 44,777 | 10,002 | 376 | 20,853 | 15,912 | 4,941 | 23.69 | 2.93 |

| Broxtowe | EM | 4,457 | 178,015 | 39,941 | 81,330 | 18,248 | 527 | 16,525 | 12,547 | 3,978 | 24.07 | 1.69 |

| Redbridge | Lon | 4,444 | 308,423 | 69,402 | 67,658 | 15,225 | 535 | 28,167 | 19,690 | 8,477 | 30.10 | 3.57 |

| Waveney | East | 4,435 | 210,703 | 47,509 | 77,377 | 17,447 | 506 | 20,811 | 12,551 | 8,260 | 39.69 | 3.68 |

| Dover | SE | 4,311 | 198,820 | 46,119 | 74,134 | 17,196 | 627 | 19,920 | 10,184 | 9,736 | 48.88 | 3.60 |

| Tamworth | WM | 4,269 | 176,679 | 41,387 | 68,041 | 15,938 | 617 | 20,840 | 13,792 | 7,048 | 33.82 | 2.68 |

| North West Leicestershire | EM | 4,268 | 227,914 | 53,401 | 73,993 | 17,337 | 538 | 17,924 | 10,974 | 6,950 | 38.77 | 3.02 |

| Dartford | SE | 4,213 | 304,185 | 72,202 | 57,613 | 13,675 | 365 | 21,616 | 10,784 | 10,832 | 50.11 | 7.05 |

| East Devon | SW | 4,204 | 237,340 | 56,456 | 80,601 | 19,172 | 601 | 18,338 | 11,674 | 6,664 | 36.34 | 2.64 |

| Shropshire | WM | 4,075 | 195,767 | 48,041 | 84,595 | 20,760 | 718 | 18,865 | 12,906 | 5,959 | 31.59 | 2.04 |

| Sedgemoor | SW | 4,045 | 142,997 | 35,352 | 56,478 | 13,962 | 378 | 18,203 | 13,702 | 4,501 | 24.73 | 2.95 |

| High Peak | EM | 3,964 | 170,210 | 42,939 | 55,859 | 14,092 | 512 | 15,211 | 9,224 | 5,987 | 39.36 | 2.95 |

| North Kesteven | EM | 3,851 | 162,764 | 42,265 | 67,724 | 17,586 | 531 | 15,536 | 9,285 | 6,251 | 40.24 | 3.06 |

| Harrogate | YH | 3,840 | 242,855 | 63,243 | 60,756 | 15,822 | 423 | 18,006 | 11,714 | 6,292 | 34.94 | 3.87 |

| South Holland | EM | 3,805 | 151,585 | 39,838 | 68,609 | 18,031 | 764 | 16,358 | 9,667 | 6,691 | 40.90 | 2.30 |

| Rugby | WM | 3,796 | 190,849 | 50,276 | 61,632 | 16,236 | 332 | 18,207 | 10,958 | 7,249 | 39.81 | 5.74 |

| Lancaster | NW | 3,717 | 128,465 | 34,561 | 40,394 | 10,867 | 515 | 15,829 | 11,708 | 4,121 | 26.03 | 2.15 |

| Kettering | EM | 3,678 | 167,600 | 45,568 | 63,722 | 17,325 | 556 | 15,360 | 10,368 | 4,992 | 32.50 | 2.44 |

| Eastbourne | SE | 3,410 | 191,520 | 56,164 | 42,649 | 12,507 | 544 | 15,718 | 12,530 | 3,188 | 20.28 | 1.72 |

| Babergh | East | 3,390 | 216,316 | 63,810 | 85,753 | 25,296 | 839 | 16,626 | 9,612 | 7,014 | 42.19 | 2.47 |

| Shepway | SE | 3,376 | 173,837 | 51,492 | 47,417 | 14,045 | 491 | 16,237 | 9,649 | 6,588 | 40.57 | 3.98 |

| Woking | SE | 3,342 | 303,755 | 90,890 | 123,293 | 36,892 | 1,417 | 19,364 | 17,299 | 2,065 | 10.66 | 0.43 |

| Arun | SE | 3,339 | 216,662 | 64,888 | 55,400 | 16,592 | 478 | 16,631 | 12,898 | 3,733 | 22.45 | 2.34 |

| Hinckley & Bosworth | EM | 3,287 | 177,674 | 54,054 | 71,915 | 21,879 | 701 | 13,811 | 8,885 | 4,926 | 35.67 | 2.14 |

| Mid Suffolk | East | 3,244 | 221,155 | 68,174 | 86,759 | 26,744 | 834 | 15,150 | 9,787 | 5,363 | 35.40 | 1.98 |

| Lewes | SE | 3,212 | 240,042 | 74,733 | 65,126 | 20,276 | 564 | 16,745 | 14,435 | 2,310 | 13.80 | 1.28 |

| Tendring | East | 3,134 | 125,245 | 39,963 | 43,434 | 13,859 | 474 | 14,106 | 10,289 | 3,817 | 27.06 | 2.57 |

| Gosport | SE | 3,126 | 145,309 | 46,484 | 61,903 | 19,803 | 605 | 14,848 | 11,633 | 3,215 | 21.65 | 1.70 |

| Selby | YH | 3,060 | 159,102 | 51,994 | 52,856 | 17,273 | 820 | 12,372 | 7,801 | 4,571 | 36.95 | 1.82 |

| Medway | SE | 3,016 | 168,810 | 55,971 | 41,641 | 13,807 | 684 | 14,453 | 9,997 | 4,456 | 30.83 | 2.16 |

| Thanet | SE | 3,015 | 146,988 | 48,752 | 20,787 | 6,895 | 268 | 13,903 | 11,189 | 2,714 | 19.52 | 3.36 |

| Mid Devon | SW | 3,005 | 155,153 | 51,632 | 43,167 | 14,365 | 404 | 13,535 | 8,057 | 5,478 | 40.47 | 4.52 |

| South Derbyshire | EM | 2,992 | 126,012 | 42,116 | 61,584 | 20,583 | 525 | 12,822 | 9,919 | 2,903 | 22.64 | 1.85 |

| Wealden | SE | 2,927 | 198,139 | 67,694 | 64,243 | 21,948 | 604 | 15,019 | 10,101 | 4,918 | 32.75 | 2.78 |

| Runnymede | SE | 2,881 | 306,065 | 106,236 | 101,956 | 35,389 | 1,189 | 17,025 | 9,813 | 7,212 | 42.36 | 2.11 |

| Uttlesford | East | 2,778 | 330,720 | 119,050 | 86,622 | 31,181 | 943 | 15,355 | 10,107 | 5,248 | 34.18 | 2.00 |

| North Warwickshire | WM | 2,682 | 132,836 | 49,529 | 51,589 | 19,235 | 594 | 12,170 | 8,492 | 3,678 | 30.22 | 2.31 |

| Tandridge | SE | 2,607 | 324,131 | 124,331 | 61,725 | 23,677 | 626 | 15,381 | 11,906 | 3,475 | 22.59 | 2.13 |

| Wokingham | SE | 2,600 | 202,382 | 77,839 | 90,322 | 34,739 | 1,748 | 15,399 | 9,876 | 5,523 | 35.87 | 1.21 |

| Barrow-in-Furness | NW | 2,584 | 70,788 | 27,395 | 19,657 | 7,607 | 373 | 11,706 | 8,892 | 2,814 | 24.04 | 2.92 |

| Adur | SE | 2,568 | 178,666 | 69,574 | 60,103 | 23,405 | 883 | 13,175 | 10,415 | 2,760 | 20.95 | 1.22 |

| Brentwood | East | 2,434 | 262,645 | 107,907 | 61,591 | 25,304 | 792 | 13,143 | 9,157 | 3,986 | 30.33 | 2.07 |

| Fareham | SE | 2,411 | 123,110 | 51,062 | 51,141 | 21,212 | 745 | 12,331 | 9,379 | 2,952 | 23.94 | 1.64 |

| City of London | Lon | 1,944 | 286,500 | 147,377 | 0 | 0 | 0 | 16,000 | 17,685 | -1,685 | -10.53 | 0.00 |

| Melton | EM | 1,821 | 94,520 | 51,906 | 31,484 | 17,289 | 642 | 8,084 | 5,154 | 2,930 | 36.24 | 2.51 |

| Richmondshire | YH | 1,518 | 66,535 | 43,831 | 19,247 | 12,679 | 318 | 6,513 | 4,634 | 1,879 | 28.85 | 3.89 |

| Castle Point | East | 1,517 | 115,965 | 76,444 | 36,418 | 24,007 | 717 | 7,741 | 5,483 | 2,258 | 29.17 | 2.08 |

| Oadby & Wigston | EM | 1,215 | 59,117 | 48,656 | 19,628 | 16,155 | 451 | 5,088 | 3,978 | 1,110 | 21.82 | 2.03 |

Operating margins

Total stock holding for HRAs at 31 March 2018 was 1,586,682. This has reduced by around 10,000 from the previous year, the main impacts continuing to be the Right to Buy and selective disposal/demolition for regeneration offset by growing development programmes. At its peak, council housing totalled more than five million homes, reduced over 40 years through the Right to Buy, demolition and around half of all authorities transferring under the large-scale voluntary transfer programme.

Turnover was £8.27bn – around £5,211 per unit annually. Average rents were £86 per week across the entire sector, across a range from £66 to £130.

Other income from charges and contributions added £14 per week to that total, with the higher amounts seen in authorities with the highest amount of flats and also numbers of leaseholders.

Operating costs were £5.98bn – around £3,769 per unit annually. Average day-to-day operating costs (management and maintenance) were around £2,738 per unit – about £52 per week – with the allocation for long-term major repairs expenditure about £1,026 per unit.

As would be expected, unit operating costs ranged widely, with the higher costs seen in London and in those authorities with more flats. As most HRAs have a combination of general needs and supported (traditional sheltered) housing, rather than being specialist towards any specific type, the range is generally narrower than for HAs.

Because of the ebb and flow of refurbishment and major repairs programmes, not all of the amount transferred to the major repairs reserve will have actually been spent in the year. Major repairs reserve balances are in the tens of millions. The amount transferred has also increased in recent years.

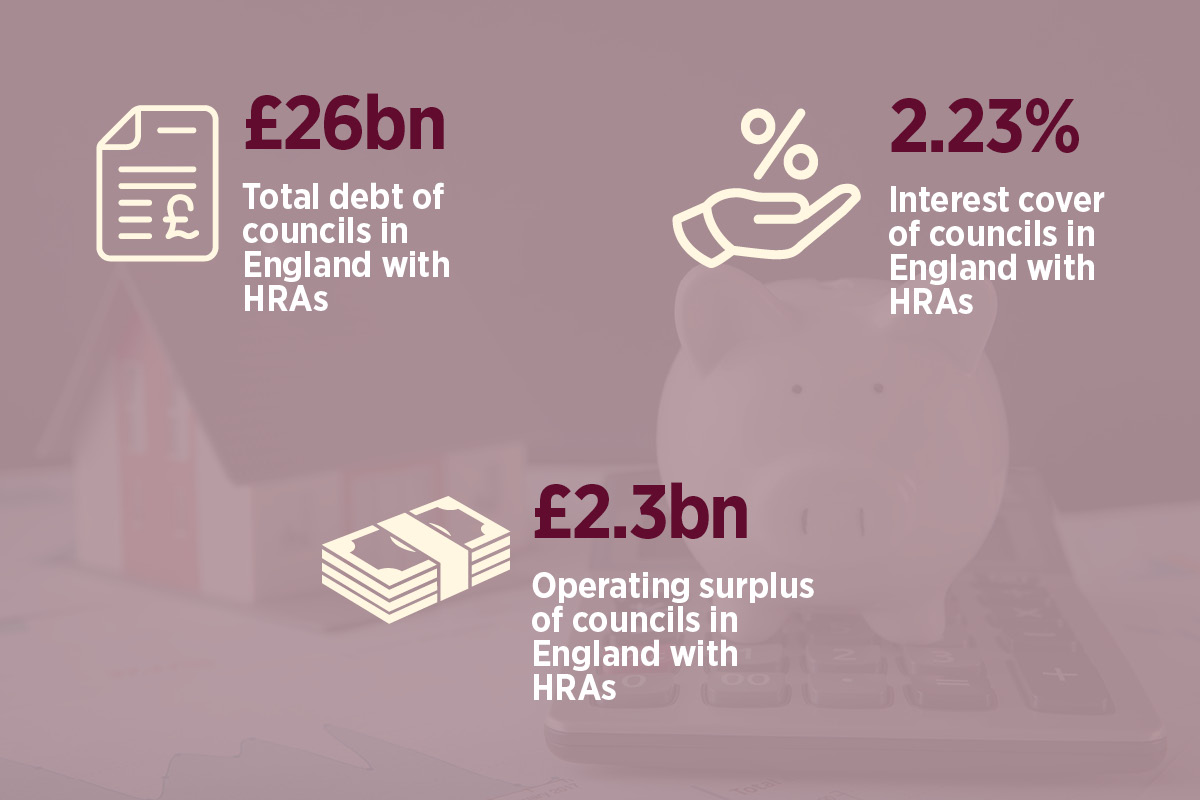

Operating surpluses were £2.29bn – around £1,441 per unit annually and around £28 per home per week, representing a gross HRA sector-wide operating margin of around 28%. Highest margins were seen at 52% and the lowest below zero in a debt-free authority drawing on reserves; the median was 30%.

The table compares these figures at a sector-wide level to HAs that form part of the global accounts (230 HAs with more than 1,000 units). Turnover and costs are lower and operating margins tighter for HRAs – this is to be expected given a range of factors:

- There has generally been less of a focus on increasing income via service charges.

- Costs exclude any irrecoverable VAT.

- Major repairs costs charged to the HRA are being held in reserve pending future commitment.

Leverage

Total debt at 31 March was £26.01bn – some £3.1m below the borrowing cap at that time. Debt was relatively stable between 2017 and 2018 having increased markedly the previous year.

Savills’ 2017 research highlighted that borrowing headroom beneath the former debt cap was being held for a range of reasons, typically as a buffer against Right to Buy, but also as a result of the four-year social rent reductions. Will authorities have more confidence now?

Unit debt levels were around £16,400. Interest on debt represented a net overall weighted average rate of 3.94%, which has been a consistent average since the self-financing settlement of 2012.

With more authorities now planning to borrow to invest in new homes and regeneration, and interest rates currently running well below this level for long-term PWLB funding (and likely to do so for some time), we can expect to see average costs of capital reduce over the forthcoming period.

Compared to HAs, average debt levels are lower, as are average costs of capital. This is to be expected as councils have been constrained by an artificially low cap, which has encouraged defensiveness while their interest costs have been drawn on a large amount of self-financing debt taken on for the 2012 settlement at preferential rates offered by Treasury via the PWLB.

Interest cover

Comparing operating surpluses to interest costs gives us a proxy for interest cover. Nationally, operating surpluses cover interest costs by around 2.23, a much higher figure than we see in the HA sector.

In theory, at least, this suggests significant amounts of additional capacity to borrow: by setting a minimum of 1.8 across those authorities above that level, immediate additional borrowing capacity could be up to £11bn, which with receipts and grant could give investment potential of up to £15bn.

As ever, the local picture is far more complex, with some wide variations in interest cover between authorities, and in one debt-free case, no interest at all. We will be doing more work to understand the position at the individual authority level so that we can make a more informed assessment of the potential for additional investment.

Accounts of the largest housing associations 2018

| Housing association | Total social and non-social units owned and/or managed | Total debt (£000) | Turnover (£000) | Turnover from social housing lettings (£000) | Operating cost (£000) | Operating surplus/(deficit) | Headline social housing cost per unit (£) | Operating margin (social housing lettings) (%) | Operating margin (overall) (%) | EBITDA MRI interest rate cover (%) |

|---|---|---|---|---|---|---|---|---|---|---|

| Places for People | 115,678 | 2,897,461 | 754,390 | 315,709 | 569,848 | 184,542 | 3147.67 | 48.04 | 24.46 | 126.83 |

| Clarion | 109,606 | 3,603,300 | 828,600 | 681,700 | 552,300 | 276,300 | 4519.9 | 36.19 | 33.35 | 149.09 |

| Sanctuary HA | 93,699 | 2,728,600 | 708,100 | 401,500 | 519,500 | 188,600 | 4208.3 | 40.07 | 26.63 | 128.44 |

| L&Q | 81,262 | 4,400,939 | 1,025,932 | 520,954 | 724,819 | 301,113 | 4014.41 | 45.6 | 29.35 | 243.96 |

| The Guinness Partnership | 62,254 | 1,205,300 | 374,000 | 336,100 | 266,900 | 107,100 | 3533.56 | 32.91 | 28.64 | 190.17 |

| Sovereign | 52,218 | 1,595,194 | 378,198 | 291,480 | 240,875 | 137,323 | 2909.99 | 42.31 | 36.31 | 255.09 |

| Peabody | 50,807 | 1,929,747 | 608,937 | 364,958 | 438,803 | 170,134 | 5741.22 | 31.63 | 27.94 | 192.23 |

| Home Group | 50,296 | 983,857 | 364,703 | 276,954 | 284,789 | 79,914 | 4409.18 | 26.86 | 21.91 | 197.68 |

| Riverside | 50,184 | 768,200 | 346,160 | 279,526 | 266,153 | 80,007 | 4341.47 | 24.85 | 23.11 | 177.79 |

| Hyde | 43,376 | 1,649,469 | 339,560 | 233,669 | 244,731 | 94,829 | 3911.53 | 37.72 | 27.93 | 57.75 |

| Optivo | 42,133 | 1,083,395 | 317,431 | 267,134 | 220,485 | 96,946 | 4303.62 | 30.18 | 30.54 | 224.01 |

| Orbit | 37,980 | 1,204,606 | 357,435 | 209,772 | 266,606 | 90,829 | 3763.53 | 37.79 | 25.41 | 183.97 |

| Together Housing | 36,678 | 622,896 | 184,155 | 161,622 | 162,197 | 21,958 | 3382.53 | 23.74 | 11.92 | 120.18 |

| LiveWest Homes | 34,143 | 732,630 | 230,626 | 171,169 | 169,024 | 61,602 | 3245.23 | 30.56 | 26.71 | 241.24 |

| Metropolitan | 33,493 | 1,138,118 | 288,131 | 202,248 | 203,807 | 84,324 | 4961.8 | 33.24 | 29.27 | 133.41 |

| Thirteen | 32,408 | 245,410 | 159,827 | 148,274 | 120,871 | 38,956 | 3073.17 | 29.12 | 24.37 | 341.76 |

| A2Dominion | 31,520 | 1,544,647 | 300,684 | 212,064 | 213,875 | 86,809 | 4264.27 | 40.66 | 28.87 | 125.99 |

| Wakefield and District Housing | 31,295 | 410,600 | 155,047 | 137,869 | 105,906 | 49,141 | 2928.39 | 36.96 | 31.69 | 263.82 |

| Stonewater | 31,166 | 847,581 | 187,225 | 166,597 | 132,790 | 54,435 | 3234.13 | 30.7 | 29.07 | 172.7 |

| Onward | 31,161 | 394,472 | 170,926 | 155,506 | 128,772 | 42,154 | 3501.17 | 23.75 | 24.66 | 316.01 |

| Midland Heart | 30,463 | 556,868 | 193,450 | 172,361 | 124,884 | 68,566 | 3114.11 | 39.54 | 35.44 | 247.07 |

| Bromford Housing Group | 29,115 | 621,775 | 174,248 | 145,650 | 116,155 | 58,093 | 3311.37 | 41.93 | 33.34 | 208.25 |

| Gentoo | 29,107 | 559,829 | 182,330 | 131,695 | 137,010 | 45,320 | 2732.72 | 31.25 | 24.86 | 230.05 |

| Notting Hill Housing | 28,746 | 1,677,400 | 371,100 | 228,100 | 257,300 | 113,800 | 5429.58 | 33.41 | 30.67 | 215.85 |

| Genesis | 28,695 | 1,590,300 | 324,500 | 249,500 | 285,500 | 39,000 | 7530.87 | 17.88 | 12.02 | 39.56 |

| Anchor | 28,501 | 312,113 | 389,062 | 347,092 | 366,410 | 22,652 | 10599.91 | 8.33 | 5.82 | 289.77 |

| Aster Group | 28,440 | 867,004 | 204,728 | 152,142 | 147,430 | 57,298 | 3639.14 | 34.84 | 27.99 | 216.67 |

| WM Housing | 28,100 | 619,869 | 149,583 | 140,027 | 109,375 | 40,208 | 3321.25 | 26.71 | 26.88 | 48.67 |

| Vivid | 27,946 | 998,212 | 228,488 | 164,882 | 142,134 | 86,354 | 2790.68 | 45.06 | 37.79 | 277.02 |

| Your Housing Group | 27,369 | 341,009 | 161,862 | 148,748 | 109,629 | 52,233 | 3811.43 | 34.31 | 32.27 | 171.01 |

| Waterloo Housing | 25,676 | 711,332 | 142,109 | 122,615 | 80,505 | 61,604 | 1920.06 | 49.03 | 43.35 | 228.46 |

| Southern Housing Group | 24,998 | 719,529 | 199,722 | 155,454 | 150,565 | 49,157 | 4726.38 | 24.63 | 24.61 | 127.57 |

| Karbon Homes | 24,417 | 279,211 | 126,678 | 107,146 | 98,191 | 28,487 | 3166.6 | 24.46 | 22.49 | 265.04 |

| ForViva | 23,084 | 171,120 | 142,319 | 79,061 | 123,982 | 18,337 | 2744.3 | 29.67 | 12.88 | 211.04 |

| Flagship Homes | 22,705 | 639,849 | 133,725 | 106,970 | 77,793 | 55,932 | 2446.23 | 47.29 | 41.83 | 233.21 |

| PA Housing | 22,304 | 688,636 | 164,666 | 138,052 | 107,729 | 56,937 | 3900.38 | 36.29 | 34.58 | 167.66 |

| Incommunities | 21,897 | 287,682 | 98,519 | 94,403 | 83,719 | 14,800 | 3005.71 | 20.21 | 15.02 | 137.26 |

| Torus62 | 21,821 | 121,241 | 112,386 | 99,910 | 74,000 | 38,386 | 2684.98 | 37.51 | 34.16 | 532.62 |

| Longhurst Group | 20,370 | 543,706 | 145,602 | 102,399 | 99,928 | 45,674 | 3264.8 | 37.62 | 31.37 | 177.53 |

| Radian | 20,233 | 825,819 | 161,676 | 120,220 | 103,312 | 58,364 | 3310.94 | 39.28 | 36.1 | 213.87 |

| WHG | 20,039 | 396,491 | 105,635 | 94,554 | 68,215 | 37,420 | 3025.43 | 40.51 | 35.42 | 194.05 |

| New Charter Homes | 19,461 | 370,786 | 103,618 | 89,335 | 79,399 | 24,219 | 3412.11 | 25.55 | 23.37 | 134.61 |

| EMH Group | 19,012 | 383,935 | 101,510 | 81,921 | 69,601 | 31,909 | 3344.11 | 35.97 | 31.43 | 177.35 |

| Accent Group | 18,944 | 329,912 | 96,058 | 91,645 | 67,081 | 28,977 | 2996.62 | 33.43 | 30.17 | 232.39 |

| Housing & Care 21 | 18,784 | 622,412 | 178,770 | 142,612 | 141,106 | 37,664 | 6022.52 | 25.19 | 21.07 | 166.77 |

| Moat Homes | 18,468 | 456,724 | 124,343 | 97,082 | 81,909 | 42,434 | 2992.18 | 42.71 | 34.13 | 232.48 |

| County Durham Housing Group | 18,065 | 113,798 | 67,619 | 66,025 | 39,819 | 27,800 | 2920.84 | 40.2 | 41.11 | 243.61 |

| Catalyst | 17,985 | 651,327 | 214,279 | 123,682 | 151,322 | 62,957 | 4759.47 | 35.52 | 29.38 | 187.57 |

| Great Places Housing Group | 17,779 | 554,482 | 100,683 | 84,796 | 69,993 | 30,690 | 3147.14 | 35.82 | 30.48 | 127.54 |

| Bolton at Home | 17,622 | 30,000 | 81,557 | 73,998 | 71,597 | 9,960 | 4254.74 | 20.02 | 12.21 | 18.45 |

| Network Homes | 17,048 | 858,784 | 210,093 | 145,899 | 151,222 | 58,871 | 6128.65 | 26.11 | 28.02 | 180.85 |

| BPHA | 16,515 | 738,894 | 117,322 | 86,455 | 61,945 | 55,377 | 2890.18 | 44.31 | 47.2 | 177.07 |

| Fortis Living | 15,948 | 289,733 | 101,357 | 79,471 | 58,546 | 42,811 | 2596.69 | 48.75 | 42.24 | 372.67 |

| Liverpool Mutual Homes | 15,503 | 157,529 | 77,235 | 71,303 | 51,236 | 25,999 | 2710.31 | 35.24 | 33.66 | 141.89 |

| Yorkshire Housing | 15,358 | 452,544 | 100,533 | 86,798 | 69,743 | 30,790 | 3737.7 | 31.89 | 30.63 | 156.12 |

| Plymouth Community Homes | 14,237 | 109,794 | 69,307 | 59,770 | 60,134 | 9,173 | 3543.47 | 10.3 | 13.24 | 33.99 |

| Hanover | 13,895 | 265,837 | 141,603 | 104,549 | 106,767 | 34,836 | 5250.92 | 22.81 | 24.6 | 309.76 |

| Paradigm | 13,862 | 711,244 | 123,942 | 87,765 | 69,950 | 53,992 | 2739.66 | 48.47 | 43.56 | 171.84 |

| Jigsaw | 13,795 | 299,256 | 68,882 | 60,634 | 39,176 | 29,706 | 2368.54 | 43.88 | 43.13 | 208.83 |

| Bernicia | 13,751 | 149,126 | 74,991 | 67,775 | 55,501 | 19,490 | 3394.42 | 28.73 | 25.99 | 194.94 |

| Total top 60 | 1,901,415 | 51,061,534 | 14,146,157 | 10,337,301 | 10,192,864 | 3,953,293 | 3886.71 | 33.78 | 27.95 | 166.33 |

| Total 230 | 2,815,250 | 72,531,667 | 20,459,299 | 15,364,118 | 14,815,724 | 5,643,575 | 3919.01 | 32.8 | 27.58 | 173.64 |

The regional picture

In future features we will aim to further break down the analysis into different types of authorities operating in different parts of the market. Regionally, the figures show some clear patterns.

Unit asset values are highest in London at £96,000 and lowest in the North West at £31,000, but by contrast there are relatively even levels of unit debt across all regions. This is influenced by the basis on which the 2012 self-financing settlement was operated – being the net present value (NPV) of a 30-year cash flow, while asset values are not cash flow based.

Turnover and cost levels vary in a similar way across the regions and operating margins show a similar pattern. Around 57% of operating surpluses arise in the four southern regions, generated from 51% of the stock highlighting that rent levels are proportionately higher in these regions.

There are many factors influencing rents and costs, not least council policy towards rent setting. It will be interesting to see how this evolves now that the debt cap has been removed and whether councillors will be encouraged to increase rents in order to finance new development.

RELATED