HA leaders more confident about delivery, survey finds

Political and economic uncertainty of past 12 months does little to knock sector confidence and appetite to build.

This article was written in partnership with

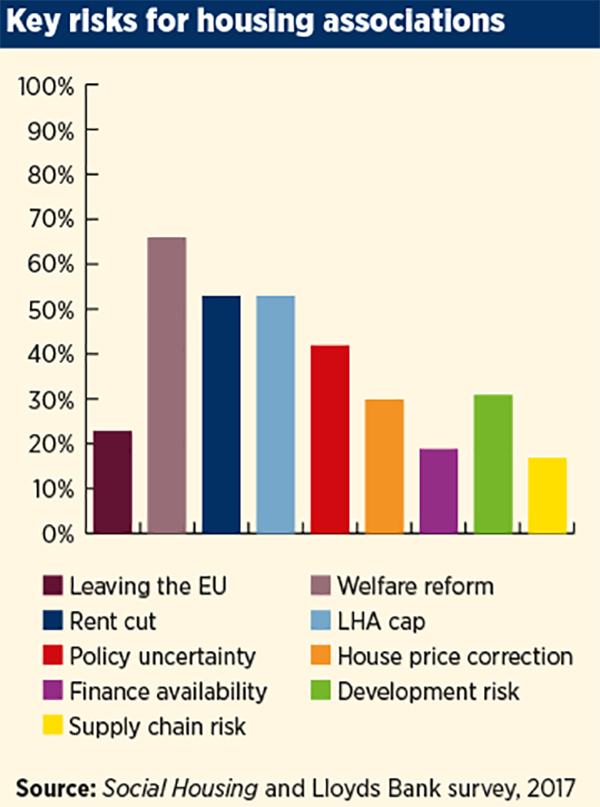

Welfare reform remains the biggest risk facing housing associations, but the vast majority feel as confident or more optimistic about coping with the challenges as they did 12 months ago.

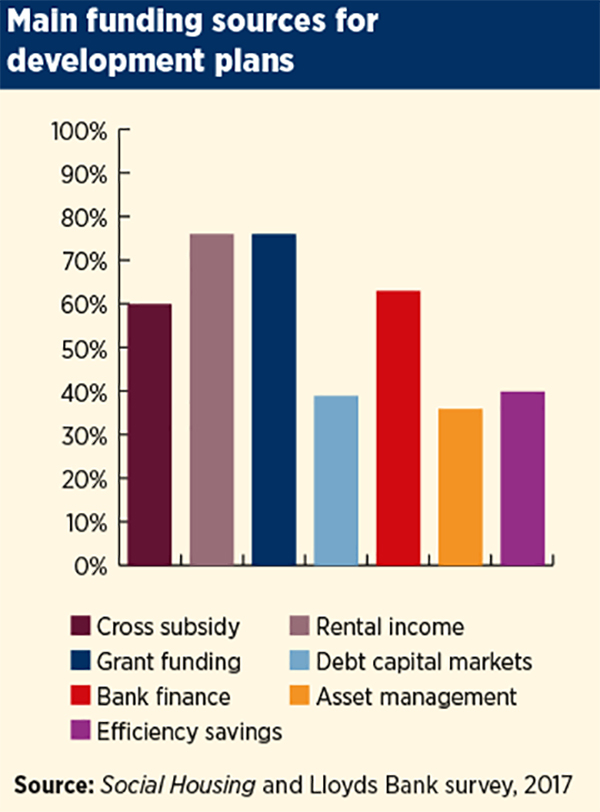

Two years after the rent cut announcement, fewer organisations say they are looking at funding their development programmes through efficiency savings such as cost-cutting and restructuring.

Nearly a third feel that greater availability of land would allow them to build more.

The views are revealed in an exclusive survey of 95 housing leaders and senior professionals by Social Housing and Lloyds Bank. It follows on from a survey last year, which examined the extent to which housing association development programmes were impacted by political and economic uncertainty.

The survey was conducted before a string of welcome announcements in October on rent policy, grant funding and the Local Housing Allowance (LHA) cap.

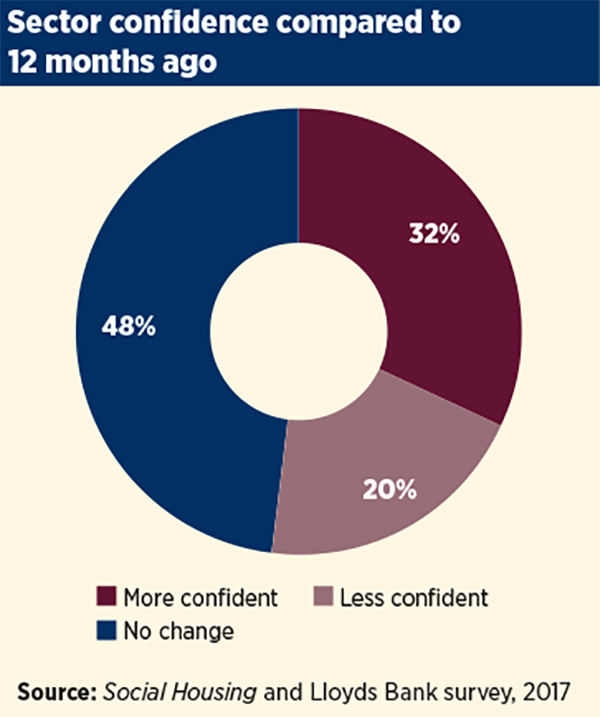

But the findings show that despite 12 months of continued uncertainty at home and abroad, a third of organisations are more confident than they were a year ago. Only 20 per cent said they feel less confident, whereas a further 48 per cent said they have experienced no change in confidence.

Respondents comprised chief executives, finance directors and development directors. A quarter of these were from housing associations with fewer than 500 homes, while the majority had up to 10,000 homes and over a quarter were from groups with more than 10,000 homes.

More than half were based in London and the South East, with almost a third across the North of England and a fifth from the Midlands, along with respondents from Scotland, Wales and Northern Ireland.

Improved confidence

Some of the responses received highlight that housing associations are of the view that their forward risk planning has put them in a strong position to weather the storm of uncertainty.

One respondent reports: “While there is still a degree of uncertainty, my organisation continues to deliver a good level of service and is adding a significant number of new homes. Our business plan is resilient and has been rigorously stress-tested.”

The fog of uncertainty over future planning is now starting to clear, which has aided associations. The Department for Communities and Local Government has committed to the return of Consumer Price Index plus one per cent rent rises from 2020; prior to this announcement, the lack of certainty around future revenue streams was a source of concern for many. In addition, with £9bn now earmarked for affordable housing development, the option of government subsidy is clearly back on the table following years of significant reductions.

Tony Oakley, mid-markets ambassador for social housing at Lloyds Bank, says that improved confidence surging through the sector has been reflected in a rise in funding requests for new housing developments.

“The sector generally seems more comfortable with its financial and operating position than perhaps it was previously,” he says.

“We’re seeing quite a broad mix of associations coming forward for funding, compared with the first 12 months after the announcement of the rent cut where the funding requests fell off a cliff.”

Risks remain

Although much has changed since 2016, there are several risks which remain just as relevant as they were a year ago. In our survey last year, housing associations said that welfare reform was the single factor they were most concerned about. Two-thirds of organisations (66 per cent) again identified it as the key risk they are facing this year.

Mr Oakley says it is understandable that landlords are continuing to identify welfare reform as one of the biggest danger areas, especially as recent media coverage has shown there is a correlation between the roll-out of Universal Credit and a rise in rent arrears.

In addition, 53 per cent of respondents saw the LHA cap as a major risk to their business plans. Mr Oakley welcomes the news that the LHA cap will not apply to any type of social rented properties, particularly those where there is an element of care included.

He says: “As with associations, we will need to look at the detail of the proposals around how care will be paid for and provided.

“We are aware that because of the proposed cap, the number of homes for older people and extra care projects being built by associations has significantly reduced. Hopefully its removal will enable associations to increase investment in these types of homes and services, where it is acknowledged there is significant demand.”

“The sector generally seems more comfortable with its financial and operating position.”

Tony Oakley, Lloyds Bank

Meanwhile, development pipelines more generally remain strong. Ninety-seven per cent of respondents said they are planning to build homes in the next 12 months. Over half (53 per cent) intend to build more than 100 homes, with eight per cent planning to construct more than 1,000 units.

And yet, there is evidence that many associations are failing to keep pace with their own development targets. More than a fifth (23 per cent) say that their organisation has not met its own target for the past 12 months.

This is not necessarily uncommon, says Mr Oakley, as he cites examples where development teams have overestimated what they can deliver: “We see this with facilities that get put in place for new development, as quite often they don’t get drawn down as fast as you would imagine. And when you speak to clients, the reason why is because the build programme isn’t going quite as fast as they envisage, so they don’t need to draw down the cash as quickly.”

Finding funding

There is a mixed picture when it comes to the main funding sources supporting housing association development programmes.

Participants highlighted rental income and grant funding as their two main funding sources, with more than three-quarters stating this is the case for their organisation. Sixty-three per cent of respondents selected the banks as a central funding source to support development, while 60 per cent said they would use cross-subsidy from market activity.

Compared with last year’s survey, however, a lower percentage of organisations are looking at funding their development programmes through efficiency savings such as cost-cutting and restructuring.

Mr Oakley says this drop-off is unsurprising, in part due to the efficiencies that have already been made by organisations.

“Generally these cuts and efficiencies were being driven since the announcement of the rent cuts,” he explains. “You can only get so far before everything is cut to the bone and you run out of internal sources to support your development activity.”

Asked more broadly about financing their group operations, just over half put banks as their primary source, with the debt capital markets close behind.

Mr Oakley says there has been a general uptick in demand for bank finance. He says landlords have responded positively to the more flexible arrangements that lenders have been able to offer in recent years.

“Banks in general have been offering shorter-dated facilities, liquidity facilities, funding for the immediate development programme,” he says.

“I think associations have had concerns as to whether they actually need to earmark funding because they plan to generate sales income within the next few years and might not actually need long-term funding.”

Associations are also increasingly looking to alternative structures to deliver new homes going forward. For instance, more than two-thirds are expecting to use a form of joint venture to aid housing delivery.

“We’re certainly seeing an increase in that type of activity through consent requests to allow the formation of joint ventures,” says Mr Oakley.

“And it’s certainly something to encourage – if housing associations and local authorities do collaborate they will deliver more, which we all want to see.”

Land and planning frustrations

The survey also asked respondents which factors, if addressed, would enable them to deliver more homes. Nearly a third (31 per cent) felt that greater availability of land would allow them to build more.

Frustrations with the planning system are also borne out in some responses. One participant says: “We have access to capital funding, but planning permissions are taking far too long and are too costly, even where we do have existing land for redevelopment.”

Mr Oakley says greater access to land and faster planning is also a key wish for many of Lloyds Bank’s clients, with the lack of access seen as one of the biggest barriers to housing delivery: “I do think funding [for development] is there – housing associations have managed a business model that’s allowed them to develop in a constrained grant environment,” he says.

“You can have the grant funding, you could have built up the capacity internally, but if you can’t find anywhere that’s actually at the right cost to build some homes you’re not going to be able to do it.”

Illustration by Getty.

RELATED