Why are a third of housing providers looking overseas for funding?

Survey finds majority of HAs set to raise funding. Simon Brandon reports

In association with:

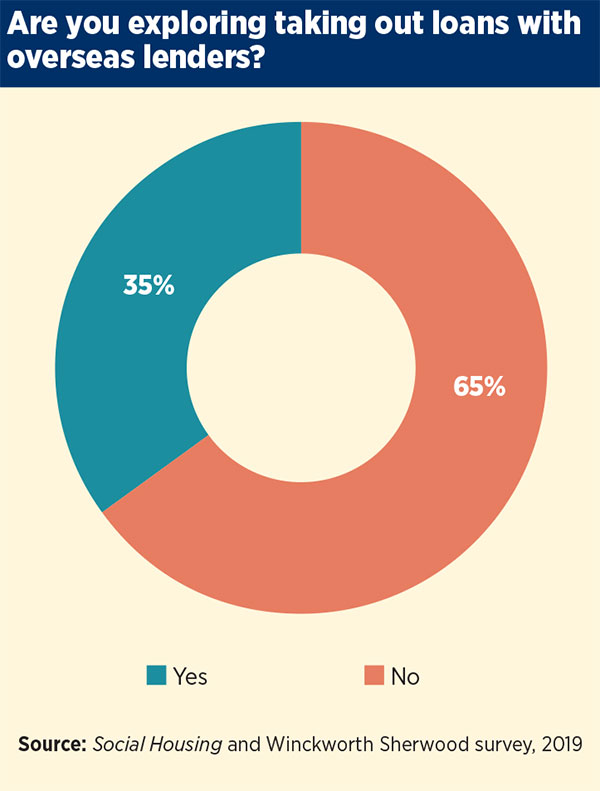

A third of housing providers are looking overseas for their funding, including to the US, the Middle East and Australia, an exclusive survey has found.

Three-quarters of the 85 respondents to a survey run by Social Housing and law firm Winckworth Sherwood said that they plan to raise debt in the next 12 months, driven predominantly by development plans, with some looking at refinancing and investing in existing homes.

The UK’s pending departure from the EU has not impacted the majority of funding strategies, according to the survey, which reached more than 144 housing associations (HAs), as well as stock-holding councils, ALMOs and developers.

Respondents were predominantly finance directors and were spread across the country, but a larger number of participants were from London, the South East and the North West.

Almost three-quarters of respondents said they plan to raise new funding over the next year, most of which will be earmarked for new development.

Encouragingly, more than half said that the UK’s plan to leave the EU has had no impact on their funding strategies, while almost 20 per cent said it has accelerated their plans. However, a similar number said it has delayed their fundraising.

One respondent said the cost of money has “remained low and is likely to continue [to be] low”, and another said they were looking to benefit from lower rates. One respondent said they had recently refinanced during Brexit uncertainty.

“We’ve still got a housing crisis and registered providers still need to develop new homes,” says Deborah Rowntree, senior banking and finance associate at Winckworth Sherwood. “Most have a strong development pipeline and they need funding to support that. As a sector, it has to carry on despite external pressures.”

The survey also reveals the growing trend for seeking overseas funding, in line with a recent spate of HAs tapping the US private placement market in 2019.

Most HAs that responded to the survey are leaning towards private placements. And confidence has grown to the point where 35 per cent of respondents are exploring taking out loans with overseas lenders – mostly in North America (45 per cent), but also as far afield as Australia and the Middle East.

The findings are set against the context of the sector’s ongoing appetite for the debt capital markets.

The majority of providers – a little more than two-thirds – still have a debt portfolio weighted towards bank loans.

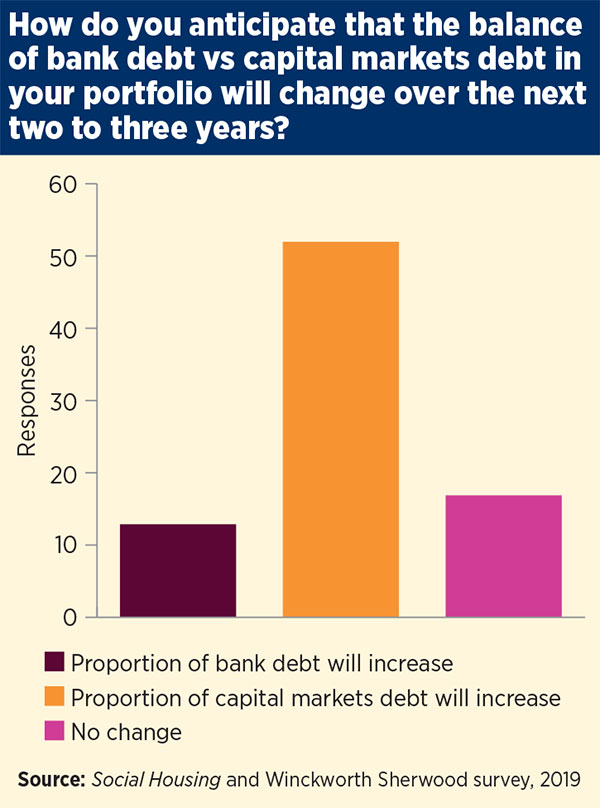

However, almost two-thirds (63 per cent) of respondents anticipated that their proportion of capital market debt would increase over the next two to three years. And more than two-thirds said their organisations plan to go out to the capital markets for both bonds and private placements in the next three years.

Of those, 41 per cent are considering private placements, 29 per cent are looking at bonds and 30 per cent are unsure.

“There is definitely a shift towards capital markets and towards new lenders,” says Louise Leaver, partner and head of banking and finance at Winckworth Sherwood. “There is more knowledge there [now] from both registered providers and investors… The crash was a long time ago; it all stems from that, but definitely within the past four to five years the growth in capital markets has really taken off.”

The shift to the capital markets for long-dated debt is also partly explained by the behaviour of smaller HAs, Ms Leaver adds.

As these providers refinance, they are having to look more towards capital markets because of the banks’ lower appetite for issuing long-term debt.

Ms Leaver says that “because more of them are doing it and there are more investors out there, it makes it slightly easier”.

One factor in the growing popularity of capital markets debt is the fact that it is more “covenant light”, because of the relative liquidity of the capital markets, Ms Leaver adds.

“Bonds can be bought and sold relatively easily, so investors do not need as much control over the issuer and its business,” she adds.

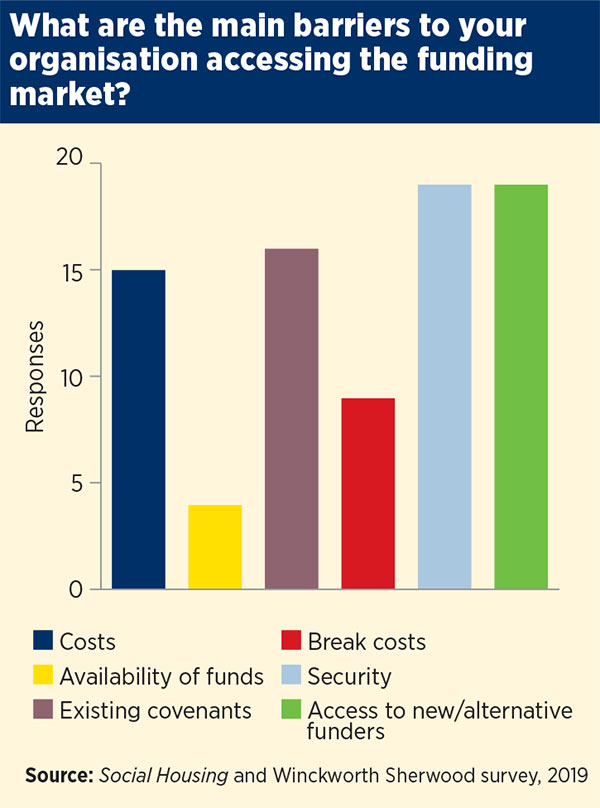

Despite this growing familiarity with capital market debt, there remain a number of barriers to accessing funding. The biggest of these include security capacity and access to alternative funders, followed by covenant constraints and costs.

Almost a quarter of respondents cited new and alternative funders as the main barrier to accessing the funding market – but this might be a case of perceptions not quite having caught up with reality, especially among smaller organisations that might not yet feel confident dipping a toe into these relatively new funding pools.

“It’s more of an opportunity for them than a barrier [for smaller providers],” says Ms Rowntree. [Not all new investors] are looking to just lend to the big players.”

One in five respondents said that their main barrier is existing covenants. “We have seen some clients doing wholesale refinancing of everything,” says Ms Leaver. “Instead of trying to find their way around existing covenants, they are taking them out altogether. That leaves them with break costs, and it might seem drastic, but there are solutions [to these barriers] one way or another.”

Another significant chunk of respondents cited costs and security – at 18 per cent and 23 per cent respectively – as their main barriers.

A quarter of respondents said they had taken out unsecured finance in the past few years, while a similar number said they planned to do so in the next two to three years. One respondent said the diminishing availability of security is becoming a constraint, as is the high cost of securitising. Another cited a reduction in the amount of administration needed with unsecured finance, as long as the price is right.

“[Unsecured debt] can be slightly more expensive – it depends on the size of the organisation,” says Ms Leaver. “Managing a security portfolio takes a lot of time and effort. Unsecured finance can offer more flexibility, too, in being able to draw down funds quickly.”

Recent years have also seen a growing number of equity investors enter the social and affordable housing market, including through real estate investment trusts and for-profit registered providers.

Two-thirds of the housing providers surveyed said they are not looking at working with equity partners for the core business. But one in four said they would for joint ventures.

One respondent said they were looking to equity to “boost our capacity to build without affecting gearing covenants”, while another said it was about “expansion and reducing risk”.

For commercial activities, most (40 per cent) are looking to inter-company lending, while more than a quarter are considering development finance.

As the sector gets used to this more varied financial landscape, we can perhaps expect shifts towards a wider range of funding alternatives to maintain velocity. A greater use of the debt capital markets is certainly on the cards.

But it is not just the sector that has grown more comfortable with alternative sources of funding – there is a growing familiarity on both sides of the table, says Ms Leaver.

“In some ways the product hasn’t changed but the understanding of it is more mainstream. Registered providers are building relationships with investors, and vice versa. There is more confidence in the sector.”

Winckworth Sherwood is hosting a breakfast briefing at the Social Housing Annual Conference on Wednesday 4 December at 8.25am. Take a look at the agenda to find out more.

RELATED